Changing environment:

Firstly, technological developments such as digitalization and automation will play a major role in driving inclusive and long-term growth affecting production process and service delivery systems and hence reshaping entire industries.

Secondly, climate change and global warming will have severe macroeconomic and financial damages. There will be policies to mitigate and address climate changes that will have fiscal consequences affecting many countries’ economic prospects.

Thirdly, a demographic factor such as reduction of working-age population ratios across the world specially in top biggest economies will face major implications as workforce and resource planning and its required management would be a key concern.

Fourthly, geopolitical scenarios such as the increasing multipolar nature of the world will continue to have impacts on global trade, including supply chains and financial networks. Moreover, the engulfment of large global corporations is also likely to affect taxation, regulation, the provision of services and market bargaining power.

Fifth and finally the global pandemic has been a catalyst for structural transformation and asking for technological change, automation, and supply-chain reallocation.

The Future of Finance:

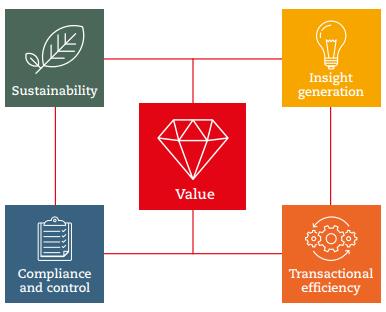

The future of finance will be supporting below four (04) pillars to define, create and distribute value for different stakeholders:

- Sustainability: The role of finance would require not only reporting on sustainability but also to define business and financial model to support long term strategic growth. For example, leading the agenda of reducing carbon emission would support sustainability as well as gaining tax advantages.

- Compliance and Control: Finance needs to identify associated risks with different business processes and set control for safeguarding of resources and reducing the chances of fraud. Designing and setting controls for Procurement to Pay(P2P), Record to Report(R2R),Expense to Pay(E2P), Payroll Management, Fixed Asset Management and General Computer Control(GCC) would allow key benefits for an entity.

- Insight generation: Different types of data analysis by Finance such as predictive, descriptive, diagnostic and prescriptive would help a business to take a more informed decisions relating to organic growth as well as for non-organic growth (leveraging merger and acquisition).

- Transactional efficiency: It means minimizing the waste of time, effort and money in the completion of a business transaction. Finance would be required to ensure transactional efficiency by reducing or removing non-value adding activities from the business processes. Such simplification would trigger operational efficiency.

Changes in Role:

Finance being a lifeblood of an entity needs to reform and address the changes in business environment with the following transformation:

- Value Partnering:

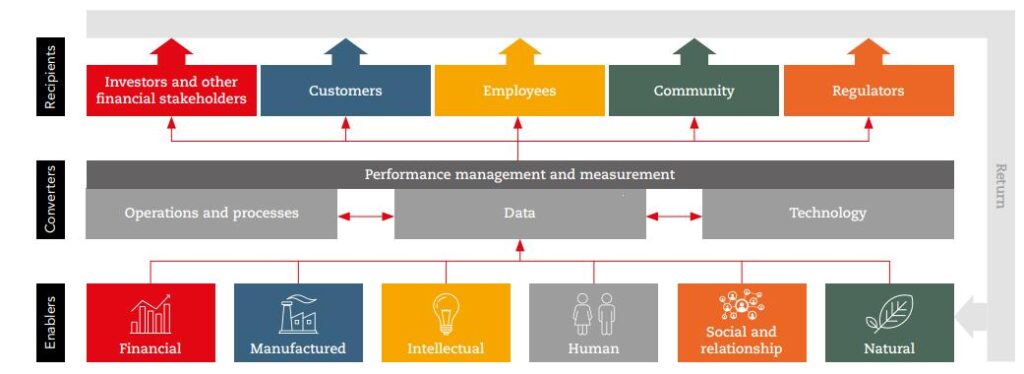

Focus should be made to make impact and contribution across organization instead of reducing cost. It means finance should identify and trigger enablers so that value is created, converted and the return is delivered to the recipients. It can be depicted as follows:

- Invest in people to build a culture and right capabilities. It is suggested to invest 10% of the operating budget and 50% of management time to develop the team.

- Make business partnering a visible “top 3 priority” and translate this into behaviors, processes ,tools or ways of working.

- Value partnering should be enforced by bridging different department, bringing numbers to life, contributing towards decision making and solving business problems.

2. Value creator: - Create values using manufactured, financial, social, intellectual, human and natural capital for the organization so that organization grows to generate financial and non-financial returns for various stakeholders as well as there is remaining value which affect sustainability for the society and the environment. It can be reflected as below:

| Returns(Financial & Non-Financial) |

- Finance Team should support value creation by contributing to developing clear strategic vision, process improvement, leveraging robust technology, data management, embracing innovation, effective communication towards different stakeholders and building skilled team.

3. Storyteller: - Data should bring different perspectives and Finance should bring life to it by cultivating new insights, identifying different correlations, and solving problems. Hence becoming a storyteller of business entity, Finance can lead the way.

- Storytelling would require clear understanding on the subject matter considering operational, benchmarking and competitor’s data as well as the audience. The cause-and-effect relationship such as what is the business problem and how such problem is going to affect the bottom line in the short and long run should be a critical part of a storytelling.

Profit to Value:

With the changing and challenging business environment, the focus of a CFO has been transforming from profit centricity to value centric approach and hence this represents an evolution towards a Chief Value Officer(CVO) who is not only a steward for the organizations’ financial resources but for all the resources that are used by an organization to create value for key stakeholders.

CVO should focus on integrative thinking which covers the following words:

- Empathizing: It means wearing the shoes of others while solving business problems. Hence active listening and empathy are the most important factors affecting the attitude of a CVO.

- Exploring : It involves searching out different routes in collaboration with the team and that requires asking questions, experimenting and modeling different scenarios to arrive at a common solution.

- Empowering: This is a vital leadership role to empower the team and external stakeholders to influence outcomes. Empowerment would encourage an open collaborative culture and entrepreneurial spirit among the employees.

- Co-creating: It refers to grabbing the opportunities that arise from involving internal and external stakeholders of an entity to trigger competitive advantage. Embracing new technology such as block chain or Robotic Process Automation(RPA) in collaboration with stakeholders would mean value sharing and benefiting all those involved.

Skills to add value:

A valued adding CFO or the CVO should continuously learn and get equipped in the following zone to tackle the future:

- Emotional intelligence: Considering self -awareness, active listening, showing empathy and gratitude would help to get understanding and managing emotions of an individual and the team. More maturity in dealing with emotional intelligence would create trust, confidence and reliability among people.

- Leadership: Focusing on critical thinking, mentorship, taking initiative, right delegation, managing conflict, effective listening and motivating others would be shaping leadership over time. Lead by example could drive the business towards goal congruence.

- Data Analytics: Advancements in machine learning, artificial intelligence and data visualization tools would enable more advanced predictive analytics, real-time insights, and self-service analytics capabilities. Data analytics skills would help identify trends, patterns, and opportunities in complex financial data to support the story telling.

- Adaptability and resilience: Change is inevitable and embracing change and adapting to new challenges in a dynamic business environment would be a key concern. Learning new technologies such as machine learning and artificial intelligence and embedding them into business for data capturing, process optimization and dashboard development would bring efficiency and effectiveness.

- Relationship management: Building and maintaining strong relationships with internal (employees and management) and external stakeholders (investors, suppliers, banks & Financial Institutes etc.) regulators would add value to contribute and support decision making process.

- Risk Management: Managing strategic and cyber security risks would be vital as risks are changing with the change in business dynamics. Learning from the best practices in the local or international market could shape up the skills for finance leader and that would help to design business strategy with holistic approach.

Author:

Mohammad Tanvir Hossain ACCA, ACMA, CGMA

Financial Controller

Upay (UCB Fintech Company Limited)

Note: The author Mohammad Tanvir Hossain ACCA,ACMA,CGMA has sketched this write up based on practical knowledge and different finance & accounting articles released by ACCA and CIMA.