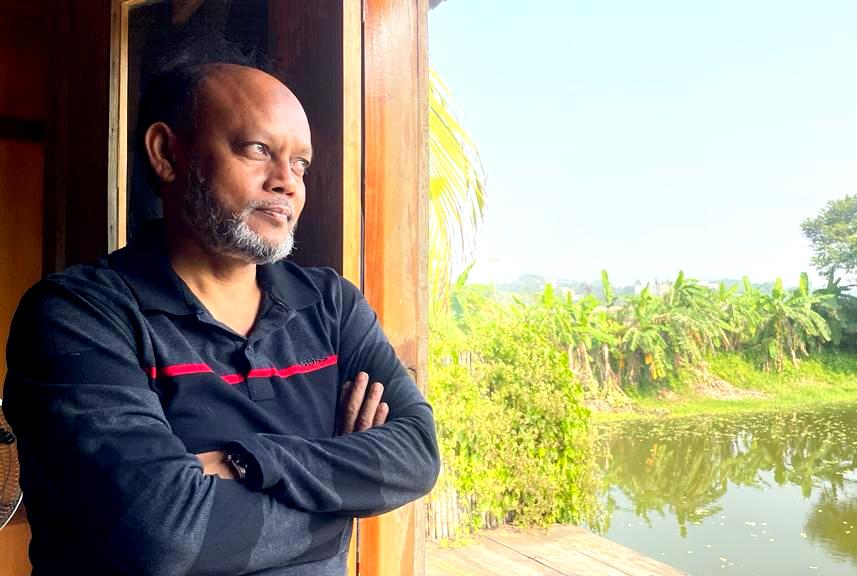

A.K.M. Mizanur Raman

EVP & Head of Islamic Banking

Eastern Bank PLC

A.K.M. Mizanur Raman, EVP & Head of Islamic Banking at Eastern Bank PLC, boasts a rich academic background and over two decades of experience in the banking sector. With a diverse educational journey spanning general, madrashah-based, and conventional studies, Mizanur Raman has excelled in various roles, contributing significantly to the growth of Islamic Banking in Bangladesh. As a CIPA and CSAA fellow of AAOIFI, he underscores his commitment to Shariah compliance. His leadership at EBL involves steering a dedicated team to develop Shariah-compliant products, manage funds, and position EBL Islamic Banking as an industry model. Mizanur Raman champions digital transformation in Islamic Banking, envisioning streamlined transactions while upholding ethical standards. His vision aligns with EBL’s commitment to prioritizing compliance, profitability, and customer-centric services in the ever-evolving financial landscape.

Let’s learn about his journey.

Mr. A.K.M. Mizanur Raman, please share your professional and academic peregrination for our readers!

I have a diverse academic career. General Education, Madrashah-based education, Science, Arts and Commerce, in all fields I have studied. My formal education began with a Govt. Primary School, then I got admission in Bhola Govt. High School where I studied up to class VII. My mother wholeheartedly wanted to see me as an Aleem (Islamic Scholar), to fulfill the wish of my beloved mother I got admission to Bhola Darul Hadidh Aliah Madrashah. I passed Dakhil and Alim from that institution. In Alim, I passed from the Science group. Then I got admitted to Siddeshwari Degree College, Dhaka and passed H.Sc. Later passed B.Sc. from University of Dhaka under govt. Jagannath College. Later I was admitted to University of Dhaka and earned Master’s Degree in Mass Communication and Journalism in 1992. I have also passed M.B.A. from Darul Ihsan University and is a CIPA(Certified Islamic Professional Accountant) and CSAA (Certified Shariah Adviser and Auditor) fellow of AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions).

As a student of Mass Communication and Journalism, I worked in some newspapers like Daily Al-Ameen, and Sabuj Bangla as a sub-editor. But after passing out from the University I started my formal career with Social Islami Bank Limited (SIBL) as a First Batch Residency Officer ( presently termed as MTO) in 1996. Later I worked for Eastern Bank Limited (EBL), Islamic Finance and Investment Limited (IFIL), SIBL, AB Bank Limited and Bank Asia Limited. In Bank Asia, I served for about 13 years. My whole banking career except in EBL (from 1998 to 2001) was in Islamic Banking. In Bank Asia I worked with Mr. Afzalul Haq, one of the renowned Islamic Banking Scholars in Bangladesh who was also my first reporting boss when I joined SIBL I was closely guided by Mr. M. Azizul Huq, one of the pioneers of Islamic Banking in Bangladesh. Lastly, I joined Eastern Bank PLC (EBL) on 3rd February 2022 as the Head of Islamic Banking.

As a career Islamic Banker, I worked in fully-fledged, Branch-based and window-based Islamic Banking. I have diversified knowledge in Islamic Banking as operations of Islamic Banking in these systems are not similar. Later, as per the inspiration of Mr. A. Rouf Choudhury, former Chairman of Bank Asia, I developed a virtual window-based real-time Islamic Banking model. I was a member of the team of the Income Sharing Ratio model developed by Mr. M. Azizul Huq where Mr. Afzalul Huq designed the ISR model as per the guidance of Mr. Azizul Huq. Another influential member of our team was Mr. Md. Ilias Khan who was also the main architect of Islamic Banking software of Bank Asia-Hikmah, developed by Era Infotech.

To enhance professional efficiency and skills I received training on Islamic Banking from REDmoney, Malaysia, Bahrain Institute of Banking and Finance (BIBF), Bahrain, Islamic Trade Finance Corporation (ITFC), a member of Islamic Development Bank (IsDB) Group and AAOIFI-a Bahrain based standard setting body who is primarily related in developing Shariah Standards, Accounting Standards, Governance Standards and Ethical Standards for Islamic Banking and Finance. I attended Islamic Finance Conference held in Dubai, UAE and Malaysia organized by WIEF (World Islamic Economic Forum) and in Bahrain, organized by AAOIFI.

Can you please briefly describe your role as the EVP & Head of Islamic Banking at Eastern Bank Limited and the key responsibilities that come with it?

As you know the environment of Dual Banking Operations (Islamic Banking side by side conventional) is very complex. Here Islamic Banking works as Bank within the Bank concept and exists a lot of dependency on conventional parts to run the day-to-day operations Islamic Banking. Here we have a group of people to render Islamic Banking services but in most cases, Islamic people are providing supporting roles. This group is responsible and accountable for developing Islamic Banking Business Model, developing Products and services, guidelines, managing funds in line with Shariah, assisting marketing team in their activities, preparing Islamic Banking business budget in consultation with all business and operations teams etc. They are also responsible for managing the Islamic Banking Balance Sheet. As a Head of Islamic Banking, I am leading my team to ensure these activities and all of these activities are under the purview of my responsibilities. It is also my responsibility to train EBL people about Islamic Banking products and services.

What motivated you to pursue a career in Islamic banking, and how do you see the industry evolving in the future?

Like my other friends, it was no choice for me to be an Islamic Banker when I joined the Banking Sector in 1996. But fortunately, my first Bank was Social Islami Bank Limited, a fully-fledged Shariah-based bank. My first posting was with Mr. M. Azizul Huq, the Managing Director of SIBL, where my supervisor was Mr. Afzalul Haq, another legendary Islamic Banker in Bangladesh. These two personalities played a vital role in my becoming an Islamic Banker through their works and motivation. Secondly working in Islamic Banking, I was convinced that in Islamic Banking I can contribute a lot to the economic development of common people complying Shariah which will contribute to both the well-being of my life here and hereafter.

In reply to the second part of this question, I want to say that, Islamic Banking started in Bangladesh in 1983. We have passed about 40 years. Within this span of time, we have successfully mounted the base of it. Now it is the time of expansion and growth. For this purpose, we must ensure Shariah compliance as we are committed to doing it and customers also keep confidence in us for the purpose. To discharge this fiduciary responsibility the Islamic Banker must identify the deviations of Shariah and must employ their all-out efforts to remove it. We should develop products in line with the needs of customers which are changing day by day giving Shariah in utmost priority. At present Islamic Banks occupy 29% of the total assets of the Banking sector in Bangladesh. My assumption within 10 years if the sector gets appropriate support from concerned authorities, it will be the mainstream Banking in Bangladesh. I shall reiterate the fact that although the number is an important thing, more important is Shariah Compliance. I am hopeful that Industry people particularly the new generations are very much concerned about it. You will be happy to know that at present we have 600 plus AAOIFI fellows getting fellowship certificates of CIPA and CSAA. These people are very much instrumental in complying with Shariah. Our Shariah Scholars are also more concerned about Shariah Compliance. Central Bank also puts utmost importance on it. In this regard, I want to acknowledge the role of the Central Bank of Bangladesh i.e., Bangladesh Bank, which played a vital role in starting and developing Islamic Banking in Bangladesh. Although Mr. M. Azizul Huq, Mr. Shah Abdul Hannan, Mowlana Abdul Jabbar, the Peer Shaheb of Baitus Sharf, Mowlana Abdur Rahim and others played important roles in their individual capacity, it is the Bangladesh Bank who always took initiatives and provided due support in establishing Islamic Banking in Bangladesh. This support is continuing. Bangladesh Bank issued its first Islamic Banking guidelines in 2009 which is now under review. They are also working on enacting Islamic Banking law. Side by side with Bangladesh Bank, Ministry of Finance’s role was and is positive for Islamic Banking. Sonali Bank, one of the state-owned banks in Bangladesh, also played an important role in starting Islamic Banking in Bangladesh. You will be happy to know that initially most of the manpower development program of Islamic Banking was taken by Sonali Bank as per the initiative of Mr. M. Azizul Huq, who was then the Principal of Sonali Bank Staff College.

Mr. Mizanur Raman, Eastern Bank Limited has been recognized for its commitment to compliance. Can you say about Shariah Compliance Issues of EBL when you will go for operations? (share some key achievements and milestones in your department during your tenure?)

I am proud to say that I am working in a Bank where compliance gets top priority. This spirit will also be upheld in the case of Islamic Banking. Keeping the commitment in mind we have developed and designed our products and services. We did not copy the product programs of other Banks but developed products in line with the market keeping Shariah compliance in mind as well as the market practices as our own. Of course, as a commercial Bank, EBL Islamic Banking will focus on profit but not at the cost of Shariah. We shall ensure Shariah both through documents and systems. No making game will be done here. To cater to the needs of our customers, side-by-side sale-based financing like Murabahah, and lease-based financing like Diminishing Musharakah, we also developed partnership-based financing products like Musharkah. Our team always keeps their eye on the market dynamics to develop new products and services in line with Shariah. InshaAllah Eastern Bank Islamic Banking will be the model of Islamic Banking in dual banking operations.

How will Eastern Bank Limited ensure compliance with Islamic banking principles and regulations, and how will you stay competitive in the market?

I have already said the EBL puts compliance at a top priority. So, EBL Islamic Banking will also give top priority to both regulatory and Shariah Compliance. For Shariah compliance, we want to be the market front-runner from day One Insha Allah. Side by side Shariah compliance we also consider to be competitive in providing services as well as booking assets and liabilities. EBL is very careful in assessing customer needs. If the selection of customers is properly done you will able to see a good asset portfolio that will contribute to the income of the Bank. A bank having a good portfolio can be more competitive than others in offering products and services at competitive prices. Besides, you must acknowledge that if Islamic Banking and financing contracts are followed meticulously the customer must find it beneficial for them in terms of income and business sustainability. We shall have some niche products also. So, Insha Allah, you will see a different Islamic Banking in EBL when it goes into operation.

In your experience, how does digital transformation impact the delivery of Islamic banking services, and what initiatives has your department taken in this regard?

Digital transformation is the reality of modern times. No bank can avoid it. Once upon a time, we were dependent on Payment Orders, Demand Drafts, TT, etc. Now all of these payment methods are near to being obsoleted. People can transfer or receive funds from home using Internet banking and digital devices. Islamic Banking is not out of this reality. I think we have to take a lot of initiatives for digitalizing our services. For Murabahah, Musharkah or Ijara’a digitalization will play a vital role in making the transaction process easier, less costly and Shariah-compliant. Our Department already has taken initiatives to digitalize the buying and selling process under Murabahah and procure assets under Ijarah. Shariah Documents management will also be digitalized. People may be able to open an account from home using a digital device. They may be able to apply for financing from home also. A lot of our conventional activities are now digitalized, so EBL Islamic Banking shall not be lagging behind.

Mr. A.K.M. Mizanur Raman, please say something to the readers!

First of all, I want to express my gratitude and thanks to honorable readers for taking the time to read this interview article. Secondly, my observation says that it is the tendency of people to criticize Islamic Banking without gathering any knowledge about it. They sometimes cannot differentiate between the system and practice. Practice can be wrong but not the system as it is based on Shariah. If we see the wrong practice, we must criticize that with a motive to bring perfection to them. In no case please don’t criticize the Islamic Banking system as a whole. However, if you have some negative observations regarding the system please bring it to the notice of practitioners, and scholars with a positive mind, and discuss it with them. Then it is expected that you will be able to know the real pictures.

Quick Chat With A.K.M. Mizanur Raman

The most outstanding achievement of your life as of now:

Getting the love and affection of Mr. M. Azizul Huq, the founder of Islamic Banking in Bangladesh.

The greatest philosopher in your view:

Hazrat Muahmmad Sallallahu Alaihissalam.

Your Icon:

Mr. M. Azizul Huq is one of the pioneers of Islamic Banking in Bangladesh.

Name the most influential books you have read:

An Introduction to Islamic Finance- Justice Mohammad Taqi Osmani, Introduction to Islamic Banking & Finance: Principles and Practices-Dr. M. Kabir Hassan, Rasem N. Kayed and Umar A. Oseni.

Your greatest fear:

Am I providing my services to the customers keeping fiduciary responsibility upheld?

Best piece of advice you’ve received:

“Be honest in your work, never tell a lie”.

You in only three words:

Servant of Allah.

The InCAP: Thank you, Mr. A.K.M. Mizanur Raman! It’s a glittering conversation with you!

Mr. A.K.M. Mizanur Raman: My pleasure! Wish you all the best! Thank you.

To read more about Professional’s stories, Please Click Here!