With the implementation of IFRS 17, the financial reporting environment for insurance contracts is experiencing a substantial transition. Effective from January 1, 2021, this groundbreaking standard, crafted by the International Accounting Standards Board (IASB), replaces the outdated IFRS 4, effectively addressing its myriad shortcomings. IFRS 17 introduces a robust, transparent, and consistent framework for accounting insurance contracts, significantly enhancing the comparability and reliability of financial statements across the global insurance industry.

Gone are the days of disparate accounting practices; IFRS 17 ushers in an era of clarity and coherence, focusing on the precise measurement of profitability and liability. This new standard provides a crystal-clear view of an insurance company’s financial performance and position, empowering stakeholders to make better-informed decisions.

In this article, I’m exploring the compelling reasons for replacing IFRS 4, the fundamental principles underpinning IFRS 17, and the transformative impact it is poised to have on the insurance sector. Additionally, I’ll navigate the challenges and uncover the myriad benefits associated with its implementation. Welcome to the new frontier of insurance accounting.

IFRS 17: changing accounting for insurance contracts to enhance transparency

IFRS 17 is effective from 1 January 2021. A company can choose to apply IFRS 17 before that date, but only if it also applies IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts with Customers. The new IFRS 17 removes different unaddressed issues of IFRS 4 and featured as providing a more comprehensive and transparent view of insurance contracts and the financial performance of insurance companies by focusing profitability recognition and liability measurement.

Key Reasons for Replacing IFRS 4

Different Accounting Policy:

IFRS 4 has allowed insurers to use different accounting policies to measure similar insurance contracts they write in different countries causing comparison challenges between companies such as some companies recognise as revenue all premiums received; others exclude from their reported revenue any saving components received through premiums. Moreover, some companies capitalise and amortise over years the costs incurred in issuing new insurance contracts; others expense these costs when incurred. Furthermore, many companies use updated discount rates to measure their insurance contracts; others use historical discount rates.

Lack of Consistency for Group:

A multi-national group is allowed to consolidate subsidiaries using non-uniform accounting policies as insurance contracts can be measured applying the relevant local accounting requirements of each jurisdiction creating lack of consistency.

Separating Deposit Components:

IFRS 4 required insurers to unbundle deposit components from insurance contracts, accounting for them separately as financial liabilities.

Key Principles in IFRS:17

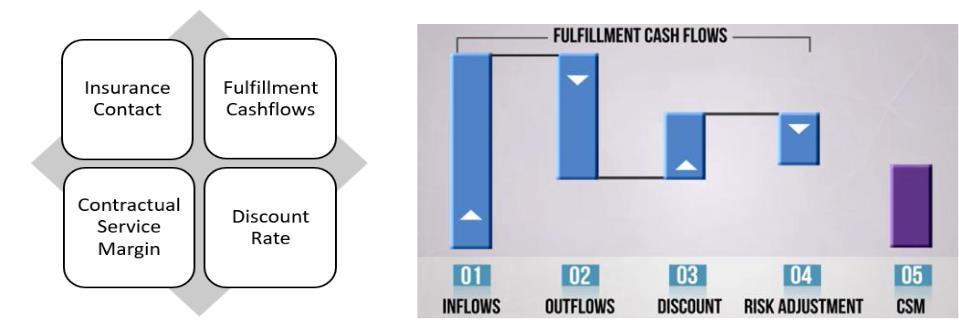

International Financial Reporting Standard 17 (IFRS 17) outlines several components and specific requirements related to the accounting and reporting of insurance contracts. Here are the main components and their respective requirements in accordance with General Model that uses ‘building blocks’ (identified in paragraph 32 of IFRS 17):

Insurance Contract

Identification of contracts that meet the criteria of an insurance contract as per IFRS 17 and therefore recognize insurance contracts when an entity becomes a party to the contract and derecognize when the contract is expired or cancelled.

Fulfillment Cashflows

Estimation of expected future cash flows arising from insurance contracts meaning premiums expected to be received from policyholders and claims expected to be paid out to them. Such cash flows that are considered are premium, brokerage costs, administrative and policy maintenance costs, future claims, claims handling cost, premium tax, value added tax and levies as applicable. Apply discount rate to discount the future cashflows to reflect time value of money.

Contractual Service Margin (CSM)

CSM is obtained after Present value of Fulfillment Cashflows is adjusted with non-financial risk and calculated at the inception which represents the unearned profit which will be recognized as and when insurance contract service is provided to policy holders over the contract period. However, if a contract or group of contracts is onerous (loss making) from inception or becomes onerous so that no profit is ever anticipated, then there is no contractual service margin.

Discount rate

This discount rate is a combination of risk-free rate and adjustment for non-financial risks. Non-financial risks include claim development risks, lapse and persistency risks and expense risks to address unexpected changes.

The summary of General Model can be depicted as follows:

IFRS 17: Presentation

- Insurance Contract Liability (Liability for Incurred Claims plus Liability for Remaining Coverage) is presented at Statement of Financial Position (SOFP) at Current Value reflecting time value of money and uncertainty. It means the Book Value is replaced by the Economic Value.

- In each financial period, the entity recognizes the Revenue for the coverage provided in that period as well as any Expenses incurred in that period in the Statement of Profit or Loss and Other

- In case of onerous contract, the loss the contract is immediately recognized as Insurance Service Expense in the Statement of Profit or Loss and Other Comprehensive Income.

IFRS 17: Disclosure

The objective of the disclosure requirements is for an entity to disclose information in the notes that, it gives a basis for users of financial statements to assess the effect of insurance contracts on the entity’s financial position, financial performance and cash flows. To achieve that objective, an entity shall disclose qualitative and quantitative information about:

a) the amounts recognised in its financial statements for contracts within the scope of IFRS 17, such as:

- Reconciliation of sources of profit

- Contracts written in the period

- Insurable interest and investment return

b) the significant judgements, and changes in those judgements, made when applying IFRS 17, such as:

- Processes to estimate inputs to methods

- Effect of changes in methods and inputs

- Confidence level for determining risk adjustment

- Discount rate used to discount cash flows

c) the nature and extent of the risks from contracts within the scope of IFRS 17, such as:

- Nature and extent of risks

- Insurance risk on gross/net basis

- Concentrations of insurance risk and claims development

- Quantitative disclosures about non-insurance risks

Key Features

Current value:

Insurance contracts will be measured at current value which means using updated assumptions about cash flows, discount rate and risk at each reporting date. This will better reflect the way a company expects to extinguish its insurance contract liabilities

Risk reflection:

Companies will use a discount rate that reflects the characteristics of the insurance cash flows to measure their insurance contracts. Companies’ financial statements will reflect the risks relating to insurance contracts that are not economically matched by assets of equivalent risk and duration.

Payment obligation:

Companies will report estimated future payments to settle incurred claims on a discounted basis. Because the time value of money will be taken into consideration, the reported expense for claims will better reflect the economic expense with more accuracy.

Risk Margin:

Companies will calculate and disclose an explicit risk margin. This will provide transparent information about uncertainty of the amount and timing of cash flows arising from insurance contracts issued by the company.

Profitability:

Companies will provide information about current and future profitability arising from insurance contracts. Companies will recognise revenue as the insurance coverage is delivered and will provide information about different profit components. Hence there is clarity on profitability per insurance contract.

Additional Disclosure:

Companies will provide additional information about estimates and judgements used to measure insurance contracts, enabling investors and analysts to better assess the timing, amount and uncertainty of cash flows arising from insurance contracts.

Key Factors

IFRS 17 implementation is a rigorous task that would address many considerations and following factors would be key to take into account with priority:

Project initiation & Management

A project team comprising key stakeholders, including finance, IT, actuarial, risk management and policy developing teams to steer the IFRS 17 implementation. A project manager in the capacity of CFO or Head of Finance should lead the project keeping the Project Charter followed up as per set milestones.

Data Management

Data management interms of quality, accuracy and completeness of existing data with infrastructure enhancement to capture big data need attention.

Financial Model

Selection of right financial model that fits the insurance entity for calculating Contractual Service Margin (CSM) and risk adjusted discount rate with option for sensitivity and scenario analysis will meet the standard requirements.

Integration

A seamless integration between actuarial valuation, financial modeling and financial reporting systems would be essential to reap the benefits of IFRS 17.

Policy Implementation

Accounting policy needs to be aligned with IFRS 17 requirements and ensure capacity development for relevant people with clear understanding. A documentation log should be kept for audit trail as well.

Regulatory intervention

Regulator should require insurance entities to ensure financial reporting and disclosure requirements addressing IFRS 17 principle. Hence this would create a benchmark for consistency and comparability of financial statements to be useful for different stakeholders. Moreover, a comprehensive guidance on IFRS 17 implementation would be a prerequisite from regulator.

Key Benefits

Transparency and accountability

IFRS 17 provides consistent principles for how insurance contracts should be measured, recognized, and presented in financial statements. It removes existing inconsistencies and enables investors, analysts and others to meaningfully compare companies, contracts and industries fostering greater transparency and accountability.

Decision Making

Compliance with IFRS 17 allows would allow a transparent picture on insurance company’s financial performance, position and risk scenario and therefore facilitating more accurate assessment, forecasting, sensitivity analysis and what- if analysis which in turn enables better decision-making.

Investments:

There is high likelihood of attracting local or foreign investments if IFRS 17 is complied with as such adherence improves financial reporting that can reduce the information asymmetry between the company and potential investors.

Operational excellence:

The process of becoming IFRS 17 compliant would require renovation of existing systems, adopting new technologies, and optimizing business processes. Such adoption will aid in eliminating redundant systems, streamlining workflows and thus making cost savings for company in the long run.

Comparability and Sustainability:

Compliance with IFRS 17 would mean insurance companies can produce financials which can be comparable globally. This is particularly important for multinational corporations and for investors who operate across borders.

Apart from regulatory requirement, IFRS 17 compliance holds significant implications for transparency, efficiency, and the long-term sustainability of insurance companies. Effective implementation offers a range of benefits that extend well beyond the realm of accounting.

key Challenges to implement IFRS 17

High Degree of Complexity

Implementing IFRS 17 will require management to make technical decisions and judgements which may have a material impact on financial reporting. So, Finance and Accounting Team needs to accommodate the changes and support the implementation. Moreover, audit committee needs to be aware of the key implementation issues as well. The application of key judgements and accounting policy decisions which need to be made by management should be reviewed by independent practitioner.

Diverse range of approaches and outcomes

IFRS 17 provides principles-based requirements and therefore it generally does not prescribe specific detailed methods. Hence, selecting appropriate techniques and developing reasonable estimates will involve a high degree of management judgement which has subjectivity. Therefore, a strong level of policy intervention is essential to exercise the judgement keeping good governance.

Time and effort

The new requirements will warrant for changing the financial recording systems, the role of actuaries and other subject matter expertise such as financial or business analysts. There will be changes in accounting policy, estimates, preparation and reporting for insurers to adopt the IFRS 17 principle. Such changes will be comprehensive involving a great deal of time and effort. Moreover, the audit and risk management committee need to be more agile for reviewing the changes and reporting to those charges with governance.

Closing Remarks

Despite various challenges, the successful implementation of IFRS 17 will help insurance and reinsurance entities to showcase more transparency, comparability and accountability. Moreover, such implementation would require engagement of professional accountants which would be a stewardship for boosting the credibility of such industry. Hence, a focus to build a resilient insurance sector permeating far-reaching economic, commercial and social benefits.

About The Author:

Mohammad Tanvir Hossain ACCA, ACMA, CGMA

Senior Director, EBAC