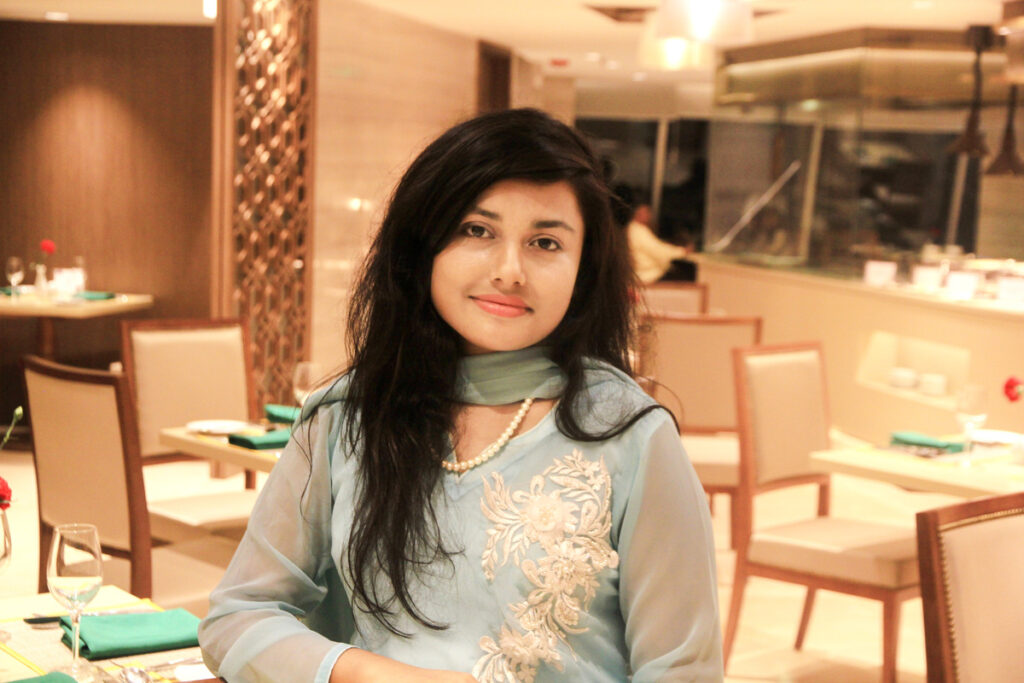

Mahamuda Jahan Chowdhury

Assistant Manager, Credit

City Bank PLC

Ms. Mahamuda Jahan Chowdhury is a dynamic financial professional currently serving as an Assistant Manager at City Bank PLC, where she has made significant strides in driving digital transformation and managing credit risk. With a strong foundation in finance, honed during her early career at Accenture, she has demonstrated exceptional skill in blending compliance with profitability, earning the highest recognition twice from the Managing Director and CEO of City Bank among 6,000 employees. Her academic achievements include a Bachelor’s degree in Finance from Stamford University Bangladesh, where she was a top performer, and a Master’s in Professional Finance from the University of Dhaka. Mahamuda’s proactive approach to risk management and dedication to continuous learning make her a standout leader in the banking sector.

Let’s learn about her journey.

The InCAP: Please share your professional and academic peregrination for our readers!

I am currently serving as an Assistant Manager at City Bank PLC, where I have been at the forefront of driving digital transformation initiatives with a keen focus on mitigating credit risk and ensuring profitability. My role involves not only evaluating credit proposals and ensuring compliance but also implementing cutting-edge technologies to streamline processes and enhance the bank’s financial performance. My dedication and impact in this role have earned me the highest recognition twice from the Managing Director and CEO of City Bank, distinguishing me among approximately 6,000 employees.

Before joining City Bank, I began my career at Accenture as a Financial Associate. In this role, I was responsible for managing financial processes, handling fixed assets, and ensuring compliance with financial regulations. This experience provided me with valuable insights into global financial operations and a deep understanding of project management within a large-scale, multinational framework.

My academic background includes a Bachelor’s degree in Finance from Stamford University Bangladesh, where I graduated in the top 5% of my class, earning a 50% scholarship across four trimesters. I further pursued a Master’s in Professional Finance from the University of Dhaka.

Can you please share an example of how you’ve successfully managed a high-risk credit portfolio?

Managing high-risk credit portfolios requires a blend of analytical precision and proactive risk management. One significant example in my career involved a digital gateway transaction fraud where a fraudster attempted to withdraw around 3 million from the bank. The fraud was part of a larger syndicate operation. Through timely detection and thorough analysis, I was able to mitigate the risk, preventing the fraud from being successful and saving the bank from a substantial financial loss. My approach not only protected the bank’s assets but also maintained the integrity of our credit processes, demonstrating the importance of combining technology with in-depth financial analysis.

How do you approach the evaluation of a credit application to ensure both compliance and profitability?

When evaluating a credit application, my approach is to strike a balance between compliance and profitability. I begin by conducting a detailed financial analysis of the applicant’s financial statements, cash flow, and repayment capacity. Simultaneously, I ensure that all regulatory and compliance requirements are met, considering both internal policies and external regulations. I also incorporate market trends and sector-specific risks into my evaluation. By blending these elements, I can recommend credit structures that are both compliant and profitable, ensuring that the bank’s interests are safeguarded while providing value to the client.

What strategies do you use to maintain strong relationships with clients while managing their credit needs?

Building and maintaining strong client relationships are crucial, especially when managing their credit needs. My strategy revolves around transparency, effective communication, and personalized service. I ensure that clients are fully informed about the terms and conditions of their credit facilities, and I work closely with them to understand their business goals. Regular follow-ups and financial reviews are part of my process, allowing me to anticipate their needs and offer tailored solutions. By fostering trust and providing proactive support, I strengthen client relationships and contribute to long-term partnerships.

How do you stay updated with the latest regulations and market trends in the banking sector?

Staying updated with the latest regulations and market trends is essential in the ever-evolving banking sector. I regularly participate in industry seminars and workshops, and I’m an active member of professional networks where current trends and regulatory changes are discussed. Recently, I attended the World Bank Youth Summit, which focused on youth-led digital transformation, providing me with insights into the future of banking, finance, and risk mitigation, particularly in the context of the Global South. I am also currently participating in climate-related training at MIT, where I am learning about climate technology. Additionally, I frequently engage in learning about credit and other risk management practices, and I am involved in ongoing workshops and training related to Blockchain, AI, and climate technology. These experiences enable me to stay informed, enhance risk mitigation strategies, and implement best practices in my role.

Can you please describe a time when you had to make a difficult credit decision? How did you handle it?

One of the most challenging credit decisions I faced involved a potential customer whose previous repayment behaviour had been poor. Despite this, their business was currently showing signs of significant prosperity. After a thorough analysis, I recognized the opportunity but also the inherent risk of potential default. To mitigate this risk, I implemented several measures, such as tightening the loan terms, requiring additional collateral, and setting up more frequent monitoring of repayment on a timely basis. With these safeguards in place, I decided to approve the proposal. The decision proved to be successful, as the customer’s repayments were smooth, and the bank’s profitability was not only protected but enhanced. This experience highlighted the importance of balancing risk with opportunity and how thoughtful risk mitigation can lead to successful outcomes for both the customer and the bank.

Please say something to the readers!

To the readers, I urge you to never forget the invaluable contributions your parents have made to your life. Their sacrifices, often made in silence, have shaped who we are today. In my own journey, the unwavering support and sacrifices of my parents are the foundation of all that I have achieved, especially considering they have all daughters. Their love and dedication are beyond measure. I pray that Allah protects them, shields them from harm, and blesses us all with the strength to honour their legacy. Let us always remember to cherish and respect our parents, for their guidance is the true compass of our lives.

Additionally, I would like to emphasize the importance of continuous learning and resilience. In our fast-paced world, staying adaptable and open to new ideas is crucial. Challenges are inevitable, but they are also opportunities for growth. Whether in your personal life or professional journey, embrace every experience, and use it as a stepping stone to achieve your goals. Remember, success is not just about reaching the top, but about the journey you undertake and the impact you make along the way.

Quick Chat With Mahamuda Jahan Chowdhury

The most outstanding achievement of your life as of now:

Being recognized twice with the highest awards by the Managing Director and CEO of City Bank among 6,000 employees, being nominated for the 4th Global Change-makers Award in the banking category, and personally challenging myself by learning to play the piano.

The greatest philosopher in your view:

Socrates, for his dedication to the pursuit of knowledge and the development of critical thinking. Additionally, Alain de Botton, for making philosophical ideas accessible and applicable to everyday life.

Your Icon:

My mother, who is the epitome of strength and resilience.

Name the most influential books you have read:

The Alchemist* by Paulo Coelho

Thinking, Fast and Slow* by Daniel Kahneman

Lean In* by Sheryl Sandberg

Your greatest fear:

Not standing up for myself and failing to live up to my potential.

Best piece of advice you’ve received:

Learn to unconditionally love and forgive yourself.

You in only three words:

Resilient, Visionary, Compassionate.

Most favourite music piece:

*Marriage d’Amour* by Paul de Senneville.

A skill you want to learn:

Self-defence and becoming an expert in quantitative finance.

Favourite Drama:

*Becoming a Lady* (Gönülçelen), the Turkish version of *Pygmalion*.

Message for girls:

Be bold, but also don’t forget to be feminine.

Skill Set

- Hard Skills: Financial Analysis, Risk Management, Credit Portfolio Management, Project Management, Advanced Excel & Microsoft Packages

- Soft Skills: Leadership & Team Management, Problem-Solving, Communication & Negotiation, Emotional Intelligence, Adaptability & Continuous Learning

Prayer for Human Civilization:

My prayer is for a world where compassion guides our actions, where we prioritize saving the earth and combating climate change through informed, collective efforts. Let us strive to end all forms of discrimination, forgo racism in terms of color, age, and religion, and put an end to genocide. We must foster a society where every individual is valued, regardless of their gender, age, race, religion, body type, or color. Let us work together to create a future where the earth is preserved for generations to come, and where every person is treated with dignity and respect.

The InCAP: Thank you, Ms. Mahamuda Jahan Chowdhury! It’s a glittering conversation with you!

Ms. Mahamuda Jahan Chowdhury: My pleasure! Wish you all the best! Thank you

To read more about Professional’s stories, Please Click Here!