Flashback of Digital Bank:

Digital banking can be traced back to the introduction of the Automated Teller Machine (ATM) by Bank of America and cards launched in the 1960s as well as the usage of mainframe computers to automate various banking functions such as check processing and customer account management. Later in the 1980s, Citi Bank started offering dial-up services providing customers to access their respective accounts by using home computers. The advent of Online banking portals with the increased internet use in the 1990s and 2000s, conventional Banks started creating online portals to enable consumers to see account balances, transfer money and pay bills from their home computers. Such online banking has a backdrop with Stanford Federal Credit Union which became the first financial institution to offer online banking in 1994 to its members, and Wells Fargo in 1996 to become the first bank providing online banking experience to its customers.

The smartphone technology permeated with internet connectivity and telco services triggered the environment of mobile banking services and in the late 2000s and early 2010s, Banks started to offer mobile apps that allowed customers to access their accounts from their smartphones, enabling them to check account balances, transfer funds, and pay bills on the go. With the passage of time, mobile banking has become an integral part of the digital banking landscape and reason could be attributed to technological advancements like blockchain and artificial intelligence (AI). Blockchain technology is being utilized to increase the security and effectiveness of cross-border payments around the world. In addition, banks are already exploring improving simplified customer service using AI-powered chatbots and virtual assistants. Hence banks powered by AI technology allowing users or customers to access all banking services 24×7 using a mobile phone or a computer without the need to personally visit the bank branch is transforming to digitally enabled bank.

Key Definition:

A digital bank (also known as neo bank, online bank, internet-only bank, or virtual bank ) is a type of direct bank that operates exclusively online without traditional physical branch networks. However, digital banks can also operate with a physical branch where customers could pay a visit for service delivery using the computer systems available in the respective branch. Therefore, digital banking simply encompasses both of the above terms and hence Anything that can be done via mobile or computer, online or offline, falls under the term digital banking.

Services offered under Digital Bank:

Digital banking has become increasingly popular in recent years due to its convenience and utility. Customers can access their accounts at any time, from any location, and perform a wide range of transactions, such as Opening & managing multi-currency accounts, checking account balances, transferring funds locally and overseas, paying different utilities and vendor bills, and applying for loans. It means the customer can expect a seamless journey in the digital landscape with more convenience and time-bound support. The general direction of digital banking transformation is to:

• Provide financial services with ease and authority.

• Facilitate using mobile banking on the go and accepting real-time payments from other parts of the world with just a click.

• Reduce time and resources used for financial transactions.

• Operate globally and increase their acceptability, resulting in more significant business growth.

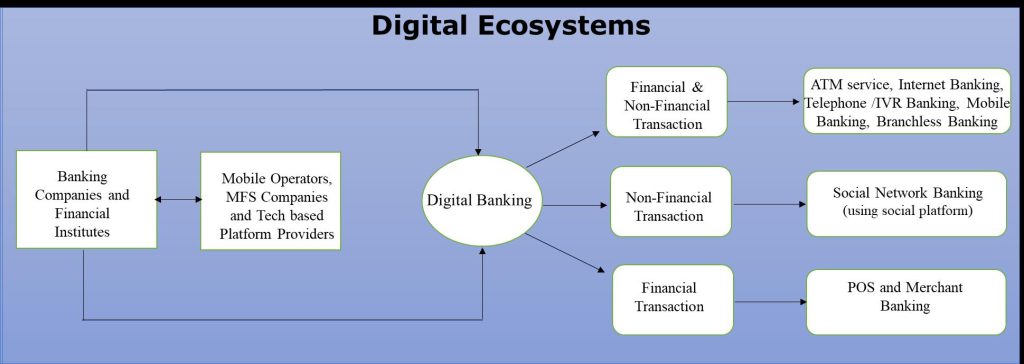

The Digital Ecosystems:

There are basically four (04) types of stakeholders commonly swirling in a digital banking ecosystem namely banks, third-party service providers, customers and the regulator. A bank provides the backbone of such banking which complies with the rules set by the regulator which is usually the central bank. The role of a third party is to act as an intermediary between the customer and the bank and such an intermediary could be Mobile Network Operator (MNO), Mobile Financial Service (MFS) entity, software House or Fintech enterprise. However, customers have to give their consent to third-party providers to carry out financial transactions on their behalf. Banks collaborate with these third parties vertically or horizontally who have advanced technological platforms such as AI and cloud-based solutions to deliver digital customer experiences across the globe. For instance, Banks are getting collaborations with tech giants such as Google Pay, Apple Pay & Ali pay to extend their digital distribution, improve the quality of their products, and reduce client acquisition expenses. The ecosystem can be depicted as follows for common understanding:

Digital Banking Models:

Digital banking models can be divided into three(03) categories: Purely digital banks, Hybrid banks, and Traditional banks with digital offerings.

Purely Digital Banks:

This model offers no physical branches or offices as all transactions are executed online which contains account openings, instant money transfer, loan or credit facilities, and access to financial management tools or customer services using chatbots or Video conferencing. These banks offer services to customers 24/7 from anywhere at any time using mobile or web-based apps and examples of such digital banks include Monzo, Revolut, Chime, and N26.

Hybrid Banks:

Such a model combines both traditional brick-and-mortar banking services and digital banking services. Customers can access both offline and online platforms and such banks integrate banking services with digital tools to provide a better user experience. Examples of hybrid banks include BBVA, which offers access to ATMs, virtual banking services, and a mobile app. Another example is Capital One, which offers online and mobile banking services as well as in-person banking options.

Traditional Banks with Digital Offerings:

Here traditional or conventional banks expedite bridging the gap between traditional banking and digital innovation. These banks have physical branches and ATMs, but they also offer online and mobile banking services. Examples of such banks include Chase, Bank of America, and Wells Fargo and they offer online and mobile banking apps that allow customers to access their accounts from anywhere in the world.

Global Scenario:

According to a Global Info Research study, the global Digital Banking market size was valued at USD 11,140 million in 2022 and is forecasted to reach USD 35,880 million by 2029 with a Compound Annual Growth Rate of 18.2%. The leading market for digital banking is the United States which accounts for 50% of the market, followed by Europe, with about 30% and the rest 20% is shared by Asia Pacific, Australia and Africa although the market penetration of such bank is significantly high in the emerging market. The transformation towards digital banking can be reasoned due to the increased penetration of smartphones, computers, internet connectivity, IoT devices, and Artificial Intelligence (AI) simulated by the agenda of increased production with reduced cost to enhance the business bottom lines. Moreover, the recent growth in cloud computing and storage has increased the significance of such technologies in the digital banking platform market.

The major player operating in the market of Global Digital Banking are Urban FT Inc. (U.S.), Misys(U.K.), Kony, Inc. (U.S.), Backbase (Netherlands), Technisys (U.S), Infosys (India), Cachet Financial Solutions Inc. (U.S), Innofis (Spain), Mobilearth (Canada). According to data from Kantar, Digital market penetration is especially high in emerging markets – for example, the proportion of consumers banking with a Digital Bank is 93% in China, 50% in India and 32% in Brazil. China is home to the world’s largest Digital Banks – including ‘We Bank’. The major players in this market have adopted strategies such as geographic expansion, product launches, collaboration, and mergers and acquisitions. The growth of the market vendors is dependent on market conditions, government support, and industry development. Thus, the vendors should focus on expanding, geographically and improving their services.

The overall growth in Digital Banking can be tagged with the rise of mobile devices and especially the smartphone which has led to an increase in mobile banking, as consumers are now able to access banking services through their mobile devices. Moreover, The COVID-19 pandemic has also accelerated the adoption of digital banking. According to a report by McKinsey, the pandemic has accelerated the digitization of banking by as much as three(03) years.

Guidelines in Bangladesh

As Fintech and digital solutions are coiling together in the global market to trigger digital customer experience, our Govt. has taken a praiseworthy move for granting the license of Digital Bank in the country through Bangladesh Bank (the ultimate regulator). This is obviously in line with the objective of attaining Sustainable Development Goals (SDGs) and taking a step towards Smart Bangladesh. The approved guidelines for Digital Bank licensing have been unveiled recently and some of the salient features are depicted below:

- A Digital Bank (DB) shall have to obtain a license from Bangladesh Bank under section 31 of the Bank Company Act, 1991 and must comply with the provisions of Bangladesh Payment and Settlement Systems Regulations 2014 to carry out the banking business in Bangladesh.

- Digital Bank

• Shall be a publicly listed company with a minimum paid-up capital of BDT 125 (one hundred twenty-five) crore and such capital shall comprise only ordinary shares where the minimum shareholding of each sponsor shall be BDT 50 lac.

• Must go for Initial Public Offering (IPO) within 5(five) years from the date of the license issued by Bangladesh Bank. - The paid-up capital shall be made available by the sponsor in a scheduled bank in unencumbered form and kept under a lien in favor of Bangladesh Bank.

- The Board of Directors shall be formed as per sec 23 of the Bank Company Act,1991 and the size of the Board and the appointment or reappointment of the director shall be governed by the same Act. Any sponsor who evaded any existing law of Bangladesh or is accused of any criminal offenses cannot be included in the Board of Directors.

- The CEO of DB shall be appointed as per regulations and directives issued by BB and the incumbent shall have at least 15 (fifteen)years of experience in the baking landscape including 5(five) years of experience in technology-based baking, regulations, guidelines, circulars, etc.

- It shall have a registered head office in Bangladesh to serve as the main point of contact for all stakeholders and such office shall host the offices of management and support staff.

- It shall offer efficient, low cost and digital financial products and services to its customers through online platforms by using Artificial Intelligence, Machine Learning, Blockchain Technology, and other advanced technologies of the 4th Industrial Revolution.

- It shall not provide any Over Counter (OTC) service and shall not have any branch, sub-brunch, window, agent or any Automated Teller Machine (ATM)/Cash Deposit Machine (CDM) /Customer Relationship Management (CRM).

- It may issue virtual cards, QR codes, or any advanced technology to facilitate the banking transaction and it can use the agent of conventional bank or MFS providers, a network of existing ATM/CDM/CRM, and MFS Network.

- It may finance or lend other than foreign trade financing and term loan to medium and large industries. It can also make inward and outward remittance and maintain Foreign Currency (FC) account under the Foreign Exchange Regulation Act of 1947.

Source: Published guidelines on Digital Bank by Bangladesh Bank

Untapped opportunities:

As we are embarking on digital era, we could count the below benefits at a gross level in our country:

Easy to Go

The digital bank would offer a more simple way to open an account without paperwork. The process would require information as per government-issued ID, tax number, and basic personal data such as a current address and contact details in the digital form. Users will execute transactions by using a laptop or mobile phone with internet access and hence the unbaked people in rural areas can reap the benefits of banking which could aid to change their livelihood.

Technological advancements

Advanced technologies such as the Internet of Things, Blockchain Technology, Augmented reality (AR), virtual reality (VR), Open APIs, Big Data, Machine Learning, Robotic Process Automation(RPA), Smart contracts and Cloud computing, etc. could be used separately or all together to bring digital revolution in the banking sector. It means customers can enjoy seamless journeys with more positive experiences while making collections, payments, or obtaining short-term financing etc. On the other hand, Digital Banks may move with lowering the operational costs as compared to conventional banks as it will be a new vehicle with advanced technology.

Contribution towards GDP

The horizontal or vertical integration and collaboration with MNO, MFS, or DFS providers would result in the creation of economic value and it means this new industry would contribute to our GDP by opening the window for employment opportunities, collection of levies and Foreign Direct Investment (FDI) for support industry, etc. North American and Asian Countries have already successfully implemented digital banking to meet the ever-growing client demand and we are optimistic about the growth of the digital banking industry as well. As the MFS industry is growing like anything in Bangladesh, the rise of such banking could also bring a breakthrough as well.

Reducing transaction cost:

It can be assumed that the transaction cost in digital banking would be less as compared to traditional banking considering the reduced overhead. However, the initial investment in technology may be a concern but the advanced technology arrives with a user-friendly interface and operational efficiency.

Challenges:

When opportunities peep up the associated challenges also come by turns and we could foresee the following challenges on the way toward digital transformation:

Building the value chain

The technology-enabled change in the digital landscape should require the bank to shift its focus towards primary and secondary activities keeping focus on product enhancement, business development, process designing, building compliance, recording & reporting framing and customer acquisition and managing relationships with customers. Moreover, the human resources hiring and training would require more sophistication and specialization to address the core business requirements and key resources such as Chief Financial Officer, Chief Information Technology Officer, Chief Information Security Officer, Chief Risk Officer and Head of Internal Control and Compliance with the right fit and skills set may not be available at all. All these collectively would require ample investments in terms of time, effort and money and that could be missing to bring the right execution.

Cyber Security

The threat of fraud in financial transactions has always been there and it affects both customers and banks causing impairment of financial resources. There are requirements for critical infrastructure security, application security, and network security. cloud security, internet of Things (IoT) security. Hence Managing cyber security would be a key concern for digital banks as they need good investments to protect the customer’s data and information from phishing, malware, ransomware, and social engineering. Obviously, this would raise capex and opex for a digital bank and therefore it may create a recurring tension.

Fiscal Compliance

This DB would kick off a new era to bring digital experience to the customers and hence attracting sponsors may require incentivization to develop this new digital industry. Fiscal compliances are highly important but if the existing compliances are enforced in full toes this could create hindrances for a new industry to grow. Regulators need to frame out a different plan in terms of direct and indirect tax benefits for this new industry.

Collaboration

This new industry would require collaboration with third parties and various intermediaries such as MNO, MFS, DFS, or tech-based platforms to build digital ecosystems horizontally and vertically. How to seal this collaboration effectively in terms of technical and financial grounds could be subject to time and cost constraints. Hence, business-to-business collaboration is essential for setting the tone of this industry and that may ask for further directives from time to time from the regulators addressing revenue or cost-sharing model, regulatory reporting parameters, transactions limit, etc.

Conclusion:

Digital banking is a highly versatile and fast-evolving market. The continuous and radical changes in digital technology helping the banks for transforming themselves by taking advantage of new technologies supported by smartphone penetration. The wave of such digital experience will trigger disruptive changes in Bangladesh as well and we are optimistic that our Digital Banking industry will grow at a faster rate to give our valued customers a full-fledged digital experience. Yes, the presence of Good Governance, Regulatory Policy Intervention and AI-based tech infrastructure, and skilled human resources will be pre-requisite to reap the benefits of going digital in our territory.

About The Author:

Mohammad Tanvir Hossain ACCA, ACMA, CGMA

Financial Controller

Upay (UCB Fintech Company Limited)