- What is IFRS 18?

IFRS 18 Presentation and Disclosure in Financial Statements which will replace IAS 1 Presentation of Financial Statements will come into force from 1st January 2027 with earlier application permitted.

The objective of new standard is to improve reporting of financial performance and gives investors a better basis for analysis and comparison.

- What is the backdrop of development of IFRS 18?

IFRS 18 has been developed as IASB has received feedback from stakeholders that IFRS Accounting Standards did not have detailed requirements on:

- classification of income and expenses in the statement of profit or loss;

- presentation of subtotals above ‘profit or loss’ (e.g. operating profit) in the statement of profit or loss; or

- aggregation and disaggregation of information presented in the primary financial statements or disclosed in the notes.

This lack of detailed requirements led to diversity in practice and lack of comparison of financial performance triggered difficulties for users of financial statements.

- Who will be affected by IFRS 18?

All stakeholders in all industries in jurisdictions that apply IFRS Accounting Standards will be affected.

- What are the key changes?

Following are the key changes introduced by IFRS 18:

| Sl. | Key changes | Summary details | Remarks |

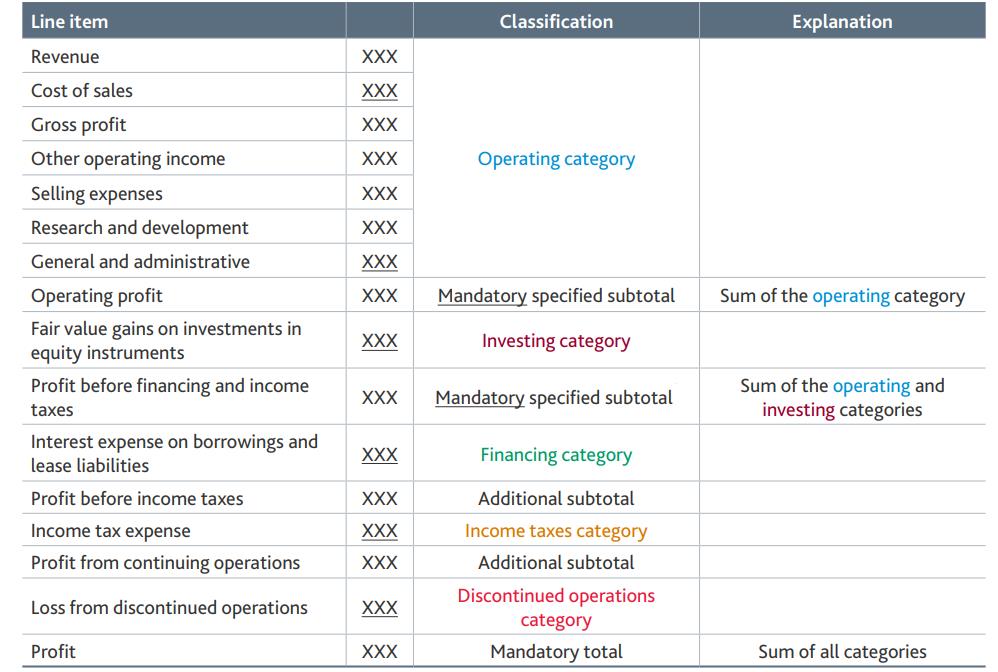

| 1 | Classification of income and expenses in the statement of profit or loss | All income and expenses are classified into following five (05) categories in the statement of Profit or Loss: The investing category The financing categoryThe operating categoryThe income tax categoryThe discontinued operations category | The statement of profit or loss has been shown in Exhibit: 01 The classification of five (05) categories has been depicted in Exhibit: 02 |

| 2. | Principle of aggregation and desegregation | A new principle has been introduced to aggregate and disaggregate assets, liabilities, income, expenses, equity, reserves and cashflows and thereafter being presented in the primary financial statements and disclosed in the notes. | The respective principle has been depicted in Exhibit:03 |

| 3. | Totals and subtotals presented in the statement of profit or loss | Mandatory subtotals in the statement of profit or loss such as operating profit and profit before financing and income tax . | Totals and subtotals are depicted in Exhibit:01 |

| 4. | Management-defined performance measures (MPMs) | IFRS 18 requires disclosures on Management-defined performance measures (MPMs) in the notes to the financial statement. For each MPM, an entity should disclose the following: why management believes the MPM provides useful information about the entity’s financial performancea description of how the MPM is calculateda reconciliation (Exhibit:04) between the MPM and the most directly comparable subtotal listed in the IFRS 18 or subtotal or total required by IFRS Accounting Standardsa description of income tax effectexplanation of any changes to the MPM. | Examples of MPMs are: – Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) – Adjusted profit or loss – Adjusted operating profit The International Accounting Standard Borad (IASB) has decided to include operating profit or loss before depreciation, amortization and impairments (OPDAI) in the list of subtotals in IFRS 18. |

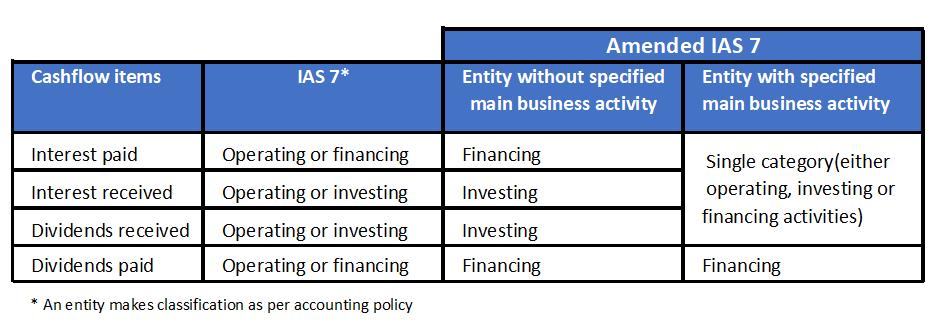

| 5. | Amendment to IAS 7 | Entities using the indirect method to prepare their statement of cash flows, the starting point will be operating profit or loss. IFRS 18 eliminates the options for classifying interest and dividend cash flows (Exhibit:05) for entities. | Prior to the adoption of IFRS 18, the starting point in the statement of cash flows was profit or loss for the financial period. |

| 6. | Amendment to IAS 33 | The amendments to IAS 33 permit an entity to disclose additional EPS only if the numerator is either a total or subtotal identified in IFRS 18 or is an MPM. | IAS 33 permits to disclose additional EPS in the notes based on any component of the statement of comprehensive income. |

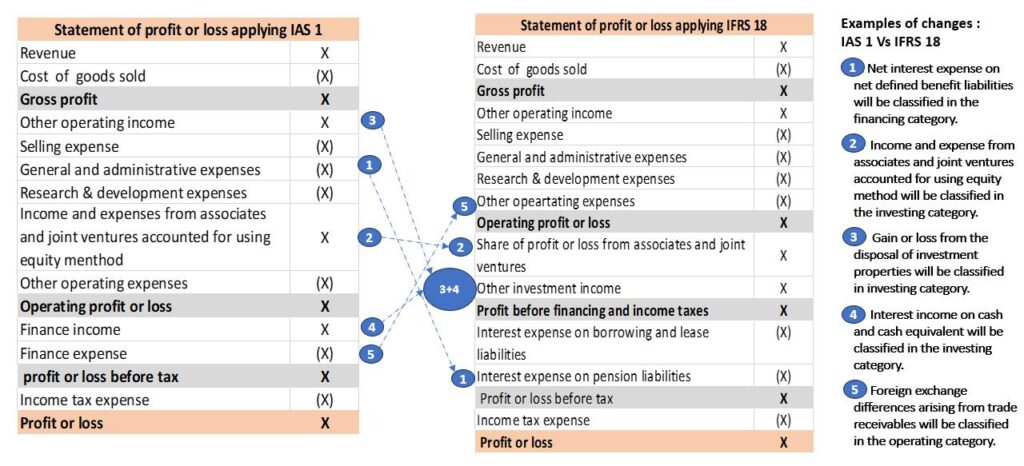

- How the changes will affect statement of profit or loss ?

The effect of IFRS 18 on statement of profit or loss has been illustrated below:

- What are other requirements in IFRS 18?

Balance Sheet:

IFRS 18 introduces a new requirement for goodwill (if applicable) to be presented as a line item in the face of balance sheet.

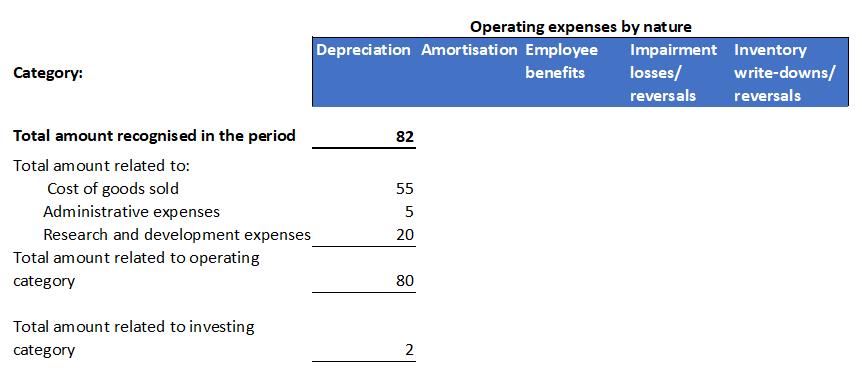

Analysis of operating expenses:

If any entity presents operating expenses by function on the face of the income statement, then the entity is required to provide the following information in a single note for each of the five (05) specific nature expenses:

- The total amount recognized and disclosed as per IFRS

- For each total, the amount related to each line item in the operating category

- For each total, a list of any line items outside the operating category that also include amounts relating to the total.

Five (05) specific nature expenses are depreciation of property, plant and equipment, investment property and right-of-use assets; amortisation of intangible assets; employee benefits; impairment losses/reversals; and write down/reversals of inventories.

An illustration is shown below considering depreciation expense:

- What are the Insights for investors?

- IFRS 18 will not result in changes in assets and liabilities or the measurement of shareholders’ equity and net income. However, key profit and loss subtotals may be impacted, especially operating profit.

- IFRS 18 will improve comparability through a new operating-investing-financing classification and through definitions of operating profit and operating profit before depreciation and amortisation (effectively EBITDA).

- IFRS 18 will result in greater disaggregation in the primary financial statements and notes due to new principles and new requirements for disclosure of expenses ‘by-nature’.

- Greater consistency of presentation and additional disaggregation under IFRS 18 will help investors to understand and forecast performance metrics.

- The limited changes to the cash flow statement will make operating cash flow more comparable and the indirect reconciliation less confusing.

Exhibit:01: Statement of profit or loss

Note 1:

Certain income and expenses classified in the investing and financing categories may be classified in the operating category if criteria are met for entities with specified main business activities (e.g banks & NBFI).

Exhibit:02 Classification of five components in the statement of profit or loss

2.1 The investing category

| Sl. | Income and expenses | Common examples |

| 1 | The income generated by the assets | a. Interest b. Dividends c. Rental income |

| 2 | The income and expenses that arise from the initial and subsequent measurement of the assets including derecognition of the assets | a. Depreciation b. Impairment losses and reversal of impairment losses c. Fair value gains and losses |

| 3 | The incremental expenses directly attributable to the acquisition and disposal of the assets | a. Transaction costs on financial assets classified as fair value through profit or loss b. Costs to sell assets, such as broker commissions on financial instruments |

2.2 The financing category

Such category comprises income and expenses from liabilities where liabilities are distinguished as follows:

| Sl. | Liabilities | Common examples |

| 1 | Liabilities arising from transactions that involve only the raising of finance such as debt or bonds. | a. Interest expenses from debenture, bonds, loan or mortgages b. Fair value gains and losses on a liability designated at fair value through profit or loss c. Dividends on issued shares classified as liabilities |

| 2 | Other liabilities arising from: payables for goods or serviceslease liabilitiesdefined benefit pension liabilities. | a. Interest expenses on trade payables b. Interest expenses on a contract liability with a significant financing component c. Interest expenses on a lease liability d. Net interest expense (income) on a net defined benefit liability (asset) e. The increase in the discounted amount of a provision arising from the passage of time f. The effect of any change in the discount rate on provision |

2.3 The operating category

The operating category comprises all income and expenses included in the statement of profit or loss that are not classified in the investing, financing, income taxes or discontinued operations categories. In other words, the operating category is a default category that includes, but is not limited to, income and expenses from an entity’s main business activities. Examples are:

- Revenue from the sale of goods or services

- Depreciation, impairment and impairment reversals of property, plant and equipment

- Amortisation, impairment and impairment reversals of intangibles

- Gains and losses on the disposal of property, plant and equipment or intangibles

- A bargain purchase gain from a business combination

2.4 The income taxes category

The income taxes category comprises:

• tax expense or tax income included in profit or loss applying IAS 12 Income Taxes

• any related foreign exchange differences.

2.5 The discontinued operations category

The discontinued operations category comprises income and expenses from discontinued operations

as defined in IFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

Exhibit:03 Principle of aggregation and disaggregation

IFRS 18 requires an entity to apply following principle for grouping and ensure that the primary financial statements and notes fulfil their respective roles:

- identify assets, liabilities, equity, income, expenses or cash flows arising from individual transactions or events;

- aggregates assets, liabilities, equity, income, expenses or cash flows into items based on shared characteristics (similar characteristics);

- disaggregates items based on characteristics that are not shared (dissimilar characteristics)

The respective principle allows an entity to consider following characteristics for aggregation and disaggregation:

- nature;

- function;

- measurement basis;

- size;

- geographical location; and

- regulatory environment.

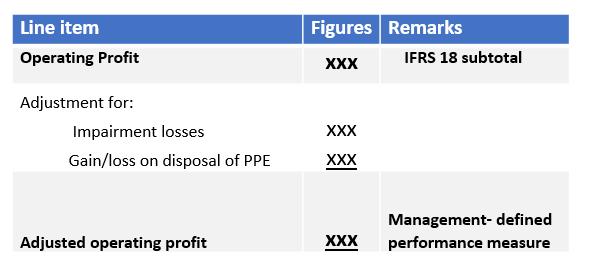

Exhibit:04 Reconciliation of Management defined performance measure (MPM) Vs IFRS 18 subtotal

How adjusted operating profit (MPM) is reconciled with operating profit (IFRS 18 subtotal) is shown below:

Exhibit:05

The following table shows amendment in IAS 7 for changes in classification of interest and dividend for entities:

Disclaimer:

The writer has sketched the above article based on IASB published materials on IFRS 18.

Written by:

Mohmmad Tanvir Hossain ACCA, ACMA, CGMA

Senior Director

EBAC

To get more insights from our Editorial section, please Click Here.