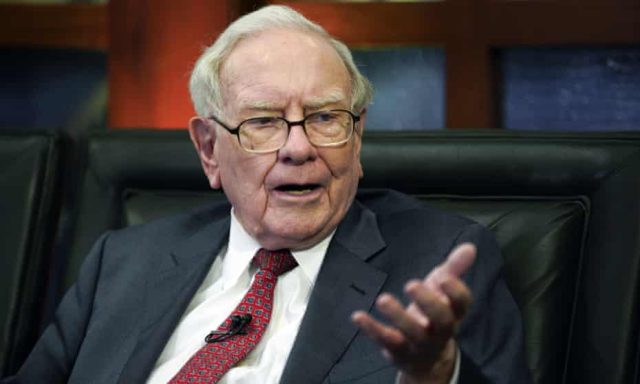

Warren Buffett’s company reported a loss of $2.7 billion due to a dropdown in the paper value of its investment portfolio in the third quarter. However, it’s most operating businesses performed well, with the specific exception of Geico. Berkshire Hathaway reported a quarterly loss on November 5, 2022, of $2.7 billion. That’s down from a $10.3 billion profit, a year before when the stock market was soaring. Berkshire reported a $44 billion loss in the second quarter of 2022. So, the article is about Warren Buffett’s Firm Reported $2.7bn Loss.

Buffett has long said Berkshire’s operating earnings are a greater measure of the company’s performance because they exclude investment gains and losses, which can vary significantly from quarter to quarter. By this, Berkshire’s operating earnings jumped 20% to $7.76 billion. So, that’s up from $6.47 billion. The four analysts surveyed by FactSet expected Berkshire to report operating earnings per Class A share of $4,205.82 on average. Berkshire said its revenue increased 9% to $76.9 billion.

Most of Berkshire’s eclectic assortment of more than 90 organizations performed well during the quarter, but the key insurance unit of Geico reported a pre-tax underwriting loss of $759 million as the cost of auto claims soared along with the prices of used cars and car parts. Soaring costs have hampered Geico since the second half of 2021.

Geico grew its rates by 5.4% during the quarter, but that was almost entirely offset because it lost 4.6% of its customers. Another notable weak spot in the results was that BNSF railroad’s profit declined 6% to $1.44 billion as it hauled 5% less freight; the cost of fuel soared, and salary costs were adjusted up to reflect the raises railroads have agreed to pay their workers in tentative agreements with their 12 unions. Most of BNSF’s peers reported significant increases in profits during the quarter. Berkshire informed its insurance units recorded after-tax losses of $2.7 billion related to Hurricane Ian. That compares with $1.7 billion in catastrophic losses a year ago related to Hurricane Ida and major European floods.

Berkshire is sitting on nearly $109 billion in cash even though it has been actively investing in the stock market in 2022, including putting more than $51 billion to work in the first quarter. That is up slightly from the $105.4 billion it held at the end of the second quarter because Berkshire’s businesses generated more cash than it spent. Although after the end of the third quarter, Berkshire did spend $11.6 billion in October to complete its acquisition of the Alleghany insurance conglomerate.

To read more Economical news, Please Click Here!