Technology-based modern services are constantly being added to Bangladesh’s banking sector. With the advent of modern technology in the payment system, money is being transferred instantly. Mobile Financial Services (MFS) have also gained popularity. Bangladesh Bank is simplifying and modernizing the payment system to reduce cash transactions. However, even after this, cash transactions are not decreasing. On the contrary, cash transactions are increasing in the country every year. The economical article contains Cash Transactions in Bangladeshi Banks Have Increased Remarkably.

If a particular bank deposits or withdraws more than Tk 10 lakh per day, it must report to the Bangladesh Financial Intelligence Unit (BFIU). The country’s financial intelligence agency considers such transactions part of ‘cash transactions’.

According to the company, in the 2016-17 financial year, the country’s banking sector had a cash transaction of 4 lakh 6 thousand 409 crores. The amount of cash transactions in the banking sector has exceeded Tk 14.43 lakh crore in the fiscal year 2020-21. As a result, cash transactions in the banking sector have increased by more than 209 percent.

The BFIU has expressed its concern over the growing number of cash transactions. The agency’s observation is that people resort to cash transactions to keep secret the source and destination of the money earned. According to BFIU’s annual report for the fiscal year 2020-21, the country’s banking sector is much more digitized. The government has also taken steps to increase mobile financial services and other digital payment systems. Yet, even after that, cash transactions are increasing every year.

Bangladesh Bank has modernized the payment system more than ever before. Among these, the two wings of Bangladesh Automated Clearing House (BACH) – Bangladesh Automated Check Processing System (BACPS) and Bangladesh Electronic Funds Transfer Network (BEFTN) have been upgraded. Besides, various payment systems of e-payment gateway, including National Payment Swiss Bangladesh (NPSB), and Real-Time Gross Settlement (RTGS), have been modernized. As a result, customers can quickly transfer any amount of money from one bank to another. However, even after this, the people concerned think that the increase in cash transactions is worrying.

Bankers say that a large portion of the cash transactions through banks is money earned through bribery and corruption. In addition, most traders have become accustomed to cash transactions to evade the government’s VAT tax. For this reason, cash transactions are not going to be reduced even after trying.

Suppose you want to know about the Managing Director of Bank Asia. Arfan Ali told that limits had been set in many countries to curb cash transactions. Cash transaction limits need to be placed in Bangladesh as well. The government will also benefit if the obligation to transact through checks above a certain amount is imposed. If it is possible to reduce cash transactions, the government’s VAT-tax revenue will increase. Moreover, it is much easier and safer to transact digitally with checks.

According to BFIU, in the financial year 2019-20, there was one crore 81 lakh 41 thousand 621 cash transactions in the banks. The amount of money transacted in rupees is 11 lakh 71 thousand 929 crore taka. In the last financial year, the number of cash transactions and the amount of money in the banks have increased. In the fiscal year 2020-21, there have been two crores of 5 lakh 69 thousand 365 cash transactions of more than 10 lakh taka in the banks. 14 lakh 43 thousand 729 crores has been transacted through this. Only 16 percent of cash transactions were at the individual level. The remaining 72 percent of transactions were institutional.

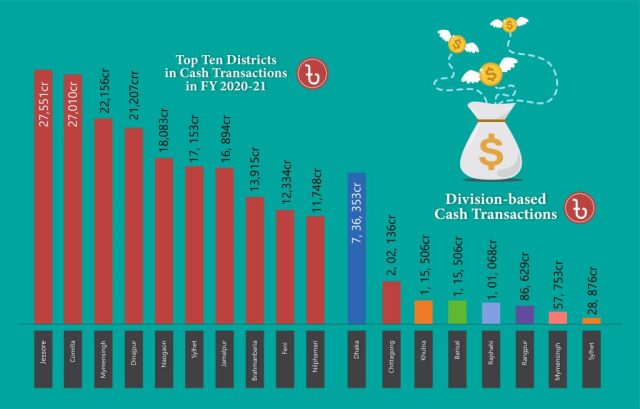

The Dhaka division accounts for 51 percent of the total cash transactions in the country’s banking sector. According to BFIU data, in the financial year 2020-21, the cash transaction in the Dhaka division was 8 lakh 36 thousand 353 crore taka. In the Chittagong division, 2 lakh 2 thousand 136 crore taka has been transacted, which is 14 percent of the cash transaction in the country’s banks. Apart from this, 6 percent of cash transactions were made in Khulna and Barisal, 6 percent in Rajshahi, 6 percent in Rangpur, 4 percent in Mymensingh, and 2 percent in Sylhet.

According to the BFIU review, cash transactions are highest in the border districts of the country. Due to illegal smuggling, drug and arms trade, and hundi activities, cash transactions are rising in the border districts. Jessore had the highest number of cash transactions among the border districts in FY 2020-21. The western community of the country had a cash transaction of Tk 26,551 crore in the last financial year.

According to several bank officials in Jessore, many cash transactions took place around the trading business in Jessore. Traders have become accustomed to cash transactions to evade VAT. It is impossible to transact with them by check or other means, even after trying. However, due to Benapole being a major route for illegal smuggling along the border, including land port, cash flow is high in Jessore. Moreover, Jessore has become a significant hub of hundi activities in the country.

Comilla has the second-highest cash transactions among the border districts. In one of the country’s largest districts, the cash transaction in the fiscal year 2020-21 has been 26 thousand 10 crores. Besides, among the top 10 districts in terms of cash transactions, Mymensingh has 22,156 crore, Dinajpur 21,207, Naogaon 17,063, Sylhet 16,153, Jamalpur 16,894, Brahmanbaria 13,915, Feni 12,334 and Nilphamari among the top 10 districts. Crores of rupees have been transacted.

The Bangladesh Financial Intelligence Unit (BFIU) is implementing various programs to prevent money laundering and money laundering, said the company’s Chief Executive. Mr. Md Masud Biswas believes. He told that if Rs 1 million or more is deposited or withdrawn in cash in the bank, it has to be reported to BFIU. Making such a report has been somewhat complicated in the past. Many bankers did not report on time due to a lack of awareness. However, in recent times, bankers have been trained in this regard. As well as simplifying the reporting process, more money transaction information is coming to BFIU than ever before. BFIU is taking various measures to discourage cash transactions. We are also trying to prevent money laundering and illegal money transactions.

To explore more Economical articles, Please Click Here!