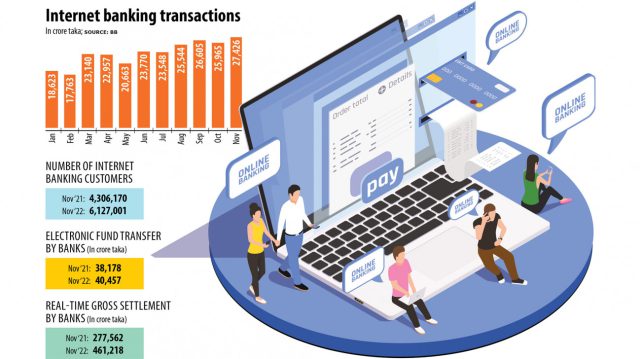

Internet banking transactions rose more than 61 percent year-on-year to Tk 27,426 crore in November in Bangladesh as an increasing number of people are opting for digital technologies to carry out financial transactions, official figures showed.

This is compared to Tk 17,009 crore registered in the same month a year earlier, according to data from the Bangladesh Bank.

Internet banking, popularly known as online banking, was introduced in Bangladesh two decades ago. But the pace has been accelerated by the coronavirus pandemic since consumers were compelled to turn to the internet to access finances from the conveniences of their homes in a bid to avoid catching the deadly virus.

Internet banking customers have nearly tripled since March 2020 to 61.27 lakh in November last year.

In the third month of 2020, when the pandemic struck the world, the number of internet banking customers was 26.49 lakh in Bangladesh. It was up more than 42 percent from 43.06 lakh in November last year.

Transactions worth Tk 6,588 crore were processed through digital platforms in March three years ago.

Local banks transacted Tk 40,457 crore using the Bangladesh Electronic Funds Transfer Network (BEFTN) in November, up from Tk 38,178 crore, an increase of 6 percent year-on-year.

In the third month of 2020, when the pandemic struck the world, the number of internet banking customers was 26.49 lakh in Bangladesh. It was up more than 42 percent from 43.06 lakh in November last year.

Transactions worth Tk 6,588 crore were processed through digital platforms in March three years ago.

Local banks transacted Tk 40,457 crore using the Bangladesh Electronic Funds Transfer Network (BEFTN) in November, up from Tk 38,178 crore, an increase of 6 percent year-on-year.

Incepted in 2011, the BEFTN was the country’s first paperless electronic inter-bank funds transfer system. It facilitates both credit and debit transactions, as a lead over the cheque-clearing system.

The network can handle credit transfers such as payroll, foreign and domestic remittances, social security payments, company dividends, bill payments, corporate payments, government tax payments, social security payments, and person-to-person payments.

It accommodates debit transactions like utility bill payments, insurance premium payments, club or association payments, and equated monthly installment payments. Most of the government salaries, social benefits, social safety net payments, and other government payments are processed through the BEFTN as well.

Tk 461,218 crore was transacted through the real-time gross settlement (RTGS) of the central bank, an increase of more than 66 percent from Tk 277,562 crore a year earlier.

In order to facilitate real-time settlement of high-value time-critical payments, BB introduced the RTGS system in 2015. It allowed banks and corporates to settle payments instantly. Individual customers are also availing of the service to settle large-value transactions.

An amount worth Tk 1 lakh and above is settled through the RTGS system while the BEFTN processes an amount less than that.

Non-bank financial institutions settled funds through the RTGS to the amount of Tk 23,169 crore in November, central bank data showed. It was Tk 17,825 crore in June, the latest for which data is available on the central bank website.

For individuals, the maximum value of each transaction is Tk 3 lakh through internet banking. The frequency is a maximum of 10 times a day and not more than Tk 10 lakh per day.

For corporate, the limit has been set at Tk 5 lakh per transaction. The maximum frequency is 20 times while a total of Tk 25 lakh could be transacted per day.