Mohammad Tanvir Hossain ACCA, ACMA, CGMA

Financial Controller

Upay (UCB Fintech Company Limited)

Mohammad Tanvir Hossain has more than Seventeen (17) years of professional working experience. Now, He is working at Upay (UCB Fintech Company Limited) as a Financial Controller. His working portfolio includes Budgeting and Costing, Internal Control, Risk Management, Operational Excellence, Process Improvement and Governance Work Program. He was trained in Lean Six Sigma Green Belt. He successfully rolled out Operational Excellence initiatives in Grameenphone Ltd. in line with the Global Cost Benchmarking (GCB) Project.

Let’s learn about his journey.

The InCAP: Now the people of the country are Tech-friendly. Keeping in mind that, we all know about technology in general and FinTech, in particular changing the financial industry globally. We are interested to know about general tech adoption at your organization.

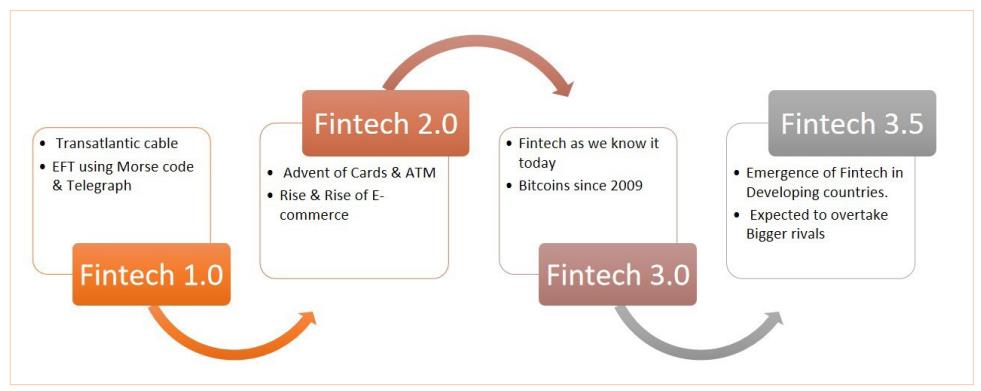

Mohammad Tanvir Hossain: Business ecosystems are coiling with the swift changes and growth of Information and Communication Technology (ICT) and that has paved the way for Industry 4.0 which is making an impact on all walks of life to solve critical and comprehensive problems. Now Machine learning (ML), the Internet of Things (IoT), and Big Data are staggering the adoption of Fintech to a different level. The use of technology in the financial sector is not new at all. This has a backdrop that started through the invention of the first automated teller machine (ATM) in June 1967 and now has transformed to disseminate formal financial services through online and mobile channels. FinTech is a technology-enabled financial innovation that generates new products and services and ultimately makes a significant effect on financial markets and institutions by facilitating breakthrough financial services with the support of the internet, gadgets, telco operators and banks. The fintech has been transforming over the decades and therefore the trail and movement could be summarized with the following diagram:

Financial markets have experienced Fintech development rapidly and a concrete example could be the e-payment system M-Pesa, which operates in Kenya, Tanzania and elsewhere, and is one of the cutting-edge Fintech success stories since its emergence just a decade ago. By effectively transforming mobile phones into payment accounts, M-Pesa has increased financial access for previously unbanked people and is a perfect example of how Fintech has disrupted the financial sector and increased efficiency across the economy.

With the wave of Fintech 3.5, Mobile Financial Services (MFS) stepped in formally in Bangladesh in 2011 as per the regulatory framework of the central bank. Since then the bank-led model services are making an impact on economic development and changing the life of people in our developing economy. It is worth mentioning that during the pandemic the usage and importance of MFS have created a buzz like anything. The daily average transaction of plus 3000 crores (in Dec 2022) could easily signify the stem of such an industry in our rising economy.

উপায় (upay) was founded to become a companion that makes the customer journey simple, secure and convenient while availing financial services.উপায় (upay) is the digital financial service brand of UCB Fintech Company Limited, a subsidiary of the United Commercial Bank. Upon receiving the license from Bangladesh Bank, উপায় (upay) started its journey in early 2021, offering a broad range of mobile financial services to people from all walks of life. উপায় (upay) products and services include mobile transactions, utility bill payment, in-store and e-commerce payment, inward remittance, salary disbursement, airtime recharge and other value-added financial services. Customers can avail of the services from our nationwide agent and merchant network at an affordable charge. Driven by the ‘Digital Bangladesh’ vision, উপায় (upay) aims to actively contribute to transforming the financial landscape of the country. উপায় (upay) offers easy access to seamless digital financial solutions, touching the lives of millions of people, and thus driving financial inclusion in the country. Our company is creating value in the economy and that could be illuminated interms of financial inclusion by providing low-income groups and unbanked people getting access to financial services at an affordable cost.

This MFS market although driven by a thin margin has untapped opportunities to grow and move and make a remarkable footprint for our economy. Promoting digital credit, Investment plans, personalized ledger systems, online merchant payments, international remittances, Government to Pay (G2P), tuition & utility bill pay, crow funding platforms, insurance coverage, etc. could help to strengthen the backbone of such an industry towards a better height. Moreover, the contribution of MFS entities to the national exchequer is making remarks for the GDP growth and could be more if the transaction volume gets significant as the day progresses. The available customer information retrieved through KYC is also bagging a great source of Big Data and helping to design and provide various innovative products and services for making a social impact. However, we need robust cyber security and risk management system and good policy intervention to protect and support the industry for its galloping growth.

What do you think is the biggest challenge for Mobile Financial Services(MFS) Industry?

Our MFS market is growing with the advancement of new technology but there are various challenges that are affecting the growth of such an industry. Some of the key challenges can be highlighted below:

Risk averter:

People by default want to avoid risk and hence people have the tendency to make a transaction using retailers or agents instead of using their own mobile phones. The reason is people have scariness or lack of self-confidence or tech phobia about using the MFS service. This is also responsible for the lower penetration of the MFS industry as only 13% are currently under the scope of services.

Knowledge:

USSD (Unstructured Supplementary Service Data): This is a Global System for Mobile Communications (GSM) protocol that is used to send text messages which are available on mobile phones (available in feature and smartphones). Using such option to operate MFS services are very handy but people have limited knowledge of this aspect and the reason behind could be lack of good command of the English language as well as lower literacy level.

National ID:

Registration for MFS service requires the validation of national ID but the tendency of people usually indicates that they are reluctant to provide such ID. Hence, there is a challenge of keeping customer information validated (also referred to as quality KYC) by the service providers.

Support partners:

The supply of electronic money by distribution houses and retailers is very crucial in the value chain of MFS. Availability of partners makes the market condensed but unavailability of partners or limited scalability could hinder the growth significantly.

Specific service by SME

Small and Medium Enterprises (SME) are using the MFS services for the disbursement of salary for a particular level of employees only and there are still opportunities for making vendor payments, micro credits and utility bill payments using the MFS channel. Bangladesh has a vibrant SME sector that contributes towards economic development and available data shows that SMEs constitute 51 percent of the microeconomic sector and employ around 36 percent of workers and contribute 48 percent to Bangladesh’s GDP. Hence, making this SME operative and agile in the MFS pipeline is possible but time-consuming as the attitude and confidence need to be boosted.

Apart from above there are other factors such as customer support available for positive experience with faster support, fragile or adverse activities of competitors, and daily transaction limit can also be held responsible to affect the expected growth.

We eagerly want to know your remark on the future of Startups Companies in Bangladesh.

The national agenda for transforming our beloved country into a “digital” has been moving ahead with the emergence of start-ups by permeating diversified sectors such as online marketplace, job site, food delivery service, gaming, online grocery, logistics delivery, traveling, makeover, medical service and IT services, etc. For the last few years, the development of start-ups is praiseworthy as our local entrepreneurs have been able to raise millions of dollars from venture capitalists and local investors as well and thus fueling our business ecosystems by solving critical business or social problems.

According to a recent study by Light Castle Partners, Bangladesh currently has over 1200 active startups, with 200 new startups are joining the tidal wave every year. Since 2013, our local startups have been to pull more than $ 800 Mn in investments and out of that fintech industry has bagged the lion’s share which is around 70%. It has been a common phenomenon that angel investors are more focused on e-commerce and retail business; whereas corporate investors are looking for investment in logistics and mobility and incubators are highly interested in retail and fintech-based entities. This has also been replicated in our startup landscape and as a result our local market has experienced some of the fastest-growing brands like bkash, ShopUp, iFarmer, Chaldal, TruckLagbe, PRAAVA HEALTH, 10 MINUTE SCHOOL, Maya, etc.

The global economy has suffered mercilessly due to the pandemic and thereafter the unwanted Russia-Ukraine war has rattled the backbone of the economy while the world was recovering in the midst of inflationary pressures and recessionary phases. Hence startup funding has seen a downward trend in 2022 and it is predicted to continue in 2023 as well. Such a wave has also affected the fund flow in Bangladesh as startups raised only USD 112 Mn in 2022 as compared to USD 415 Mn in 2021.

The success factors for our startup landscape are subject to collaboration with multiple components such as policy & regulatory intervention, public-private support, digitization, tech-based skills development, smart financial market, fiscal support in terms of tax benefits and simplified profit repatriation etc. As we are already aware that ICT ministry has already established Startup Bangladesh Ltd., a flagship venture capital fund with an allocated capital of BDT 500 crores, on march 2020 to flourish the ecosystems by providing support to early-stage tech-based companies in the form of capital, financial guidance, and operational guidance. Going forward, the robust footprint of Startup Bangladesh Ltd. could be a strong and stringent support for our ecosystems where we could reap the benefits in terms of tech-based innovation, creation of employment opportunities, business promotion for Non-Resident Bangladeshis(NRB) and road shows for attracting more foreign investments etc. in line with the vision of Digital Bangladesh.

What do you think regarding corporate tax reduction in Bangladesh?

Reduction in corporate tax can be achieved either through tax avoidance or tax evasion. For tax avoidance, there should be robust tax planning that could minimize the burden of tax. Whereas tax evasion is illegal means because this is non-compliance in the eye of tax regulation and subject to a disallowance of allowable expenses, fine and moreover the entity is represented as suspicious to the regulators.

In the current income tax ordinance 1984, there is a provision of minimum tax [u/s 82(c)] and the company or business entity that falls under the purview of such minimum tax could be subject to a higher effective tax rate than the fiscal rate (corporate tax rate). Hence the revision in the minimum tax clause is recommended to reduce or minimize the tax burden.

However, a reduction in the corporate tax rate as per the finance bill will have a positive impact on the company which does not fall under the purview of minimum tax. Here, the respective company could enjoy more profit after tax which could be distributed to shareholders or retained for reinvestment. This has a positive impact on future economic development.

Mr. Tanvir Hossain, how would you define your long and bright professional life? How has your academic life brightened you?

Alhamdulillah, it’s been a 17-year colorful journey which has been coiled by working in different sectors like Telco, Manufacturing, International NGO, Startup and Mobile Financial services that gave ample opportunity to learn from the market with the solid backbone for adding value towards the entity. Working with popular brands like Grameenphone Ltd., BRAC, Social Marketing Company Ltd and United Commercial Bank (UCB) Fintech Company Ltd. has added diversified feathers to raise the capability of contributing towards business growth.

The professional learning and aspiration to move forward have given me the prospect to go for professional study and by the grace of Almighty Allah, I have been able to claim the membership from Association of Chartered Certified Accountants (ACCA), UK and Chartered institute of Management Accountants(CIMA), UK within a very short span of time. The double-decker has been contributing with the stripe of commercial acumen, thinking process and rational decision-making.

The opportunity to study MBA and BBA with Major in Accounting & Information systems at University of Dhaka, the apex university of the country, was the stepping stone to enhance the learning curve and obviously that helped a lot to make a position in the competitive job market. Primary and higher secondary Schooling in Riyadh, Saudi Arabia also made a trailing mark to know the multicultural environment and languages.

We are attentive to know the influence or inspiration that shaped you and contributed to becoming the person you are today.

Initial inspiration has been built from my family and especially my beloved mother who was my first teacher and always inspired me to be on my feet and raise the threshold of personal competitiveness to tackle the odds in stiff competition. From childhood till professional education, my mother always influenced me with the word “Go ahead, you can do it”. No doubt, honesty from my father has placed a significant footprint in my daily life and my wife and kid are supporting me regularly to see me outshine as life moves on.

Moreover, my first job with the telco giant in BD has played a considerable hint in developing the backbone for tacking the future. The respective capacity development there shaped up the collaborative attire and communication style and obviously still supports me for positioning in this competitive market.

It is noteworthy to mention that the childhood environment and culture in Riyadh, Saudi Arabia has also paved the remark for shaping my personal attitude and I am indebted to my parents for raising me there.

You are an idol to many people. Say something to them.

Be honest and straightforward while making interaction with people. Try to support people by making things simple and timebound and never expect any return. Focus should be given on personal development in terms of self-learning, sharing knowledge and networking with professionals to create potential opportunities.

Quick Chat with Mohammad Tanvir Hossain

The most outstanding achievement of your life as of now:

While pursuing ACCA, clinched the country topper twice in a row in Advanced Financial Management and Advanced Audit & Assurance.

In the corporate ladder, being the finance leader in Somatec Pharmaceuticals Ltd., changed the attitude of the people toward a performance-driven culture by inserting operational excellence and process optimization.

The greatest philosopher in your view:

The greatest human being on earth, our prophet Hazrat Muhammad SW(PBUH) whose lifestyle, attitude and vision are unparallel and invincible.

Your Icon:

My paternal uncle Mr. Shakebul Karim Romel, Chairman of Ventura Properties Ltd. who has set an example for the young entrepreneurs to delivering an outcome from the scratch.

Name the most influential books you have read:

The Art of War by Sun Tzu.

Your greatest fear:

If I fail to perform, then I will be out of the success track.

Best piece of advice you’ve received:

My beloved mother always used to say, “The boat of honesty will stand on high at any cost in any adverse weather”.

You in only three words:

Integrity, Commitment, Teamwork.

Skill Set

- Hard Skills: Business process development, Developing internal control systems, Financial Modelling, Financial analysis and reporting, Driving operational excellence initiatives & Project Management.

- Soft Skills: Business negotiation and collaboration, Developing bench for future-ready, Public speaking & Analytical thinking

Prayer For The Human Civilization:

Fair and unbiased treatment for all so that the culture of respect, modesty and integrity can be practiced for better and safe environment. Words cannot change things, we must act and play the role accordingly.

The InCAP: Thank you, Mr. Tanvir! It’s a glittering conversation with you!

Mohammad Tanvir Hossain: My pleasure! Wish you all the best! Thank you

To read more about Professional Icon’s stories, Please Click Here!