Sonali Bank UK Limited is the only Bangladeshi bank based in the United Kingdom with 51% share capital of the Government of Bangladesh and the remaining 49% share capital of Sonali Bank Limited. It is approved by the Prudential Regulation Authority (PRA) of the UK government and regulated by the Financial Services Authority (FSA) and the Prudential Regulation Authority (PRA). The Editorial is dedicated to Historic Success in The Regime of Ataur Rahman Prodhan.

After the country’s independence, it started as an exchange house in 1974 to provide remittance services to Bangladeshi communities on UK soil. A letter of consent was sent to the government to launch a full-fledged bank in the name. Following this, Sonali Bank (UK) Limited started its banking activities in the United Kingdom on 10 December 2001 as a full-fledged bank.

List of CEOs of Sonali Bank (UK) Limited from 2009 to 2020:

1) Mr. Khandaker Iqbal (24-07-2009 to 30-03-2012)

2) Mr. Md. Ataur Rahman Pradhan (31-03-2012 to 08-05-2015)

3) Mr. M Sarwar Hossain (16-12-2015 to 24-11-2020)

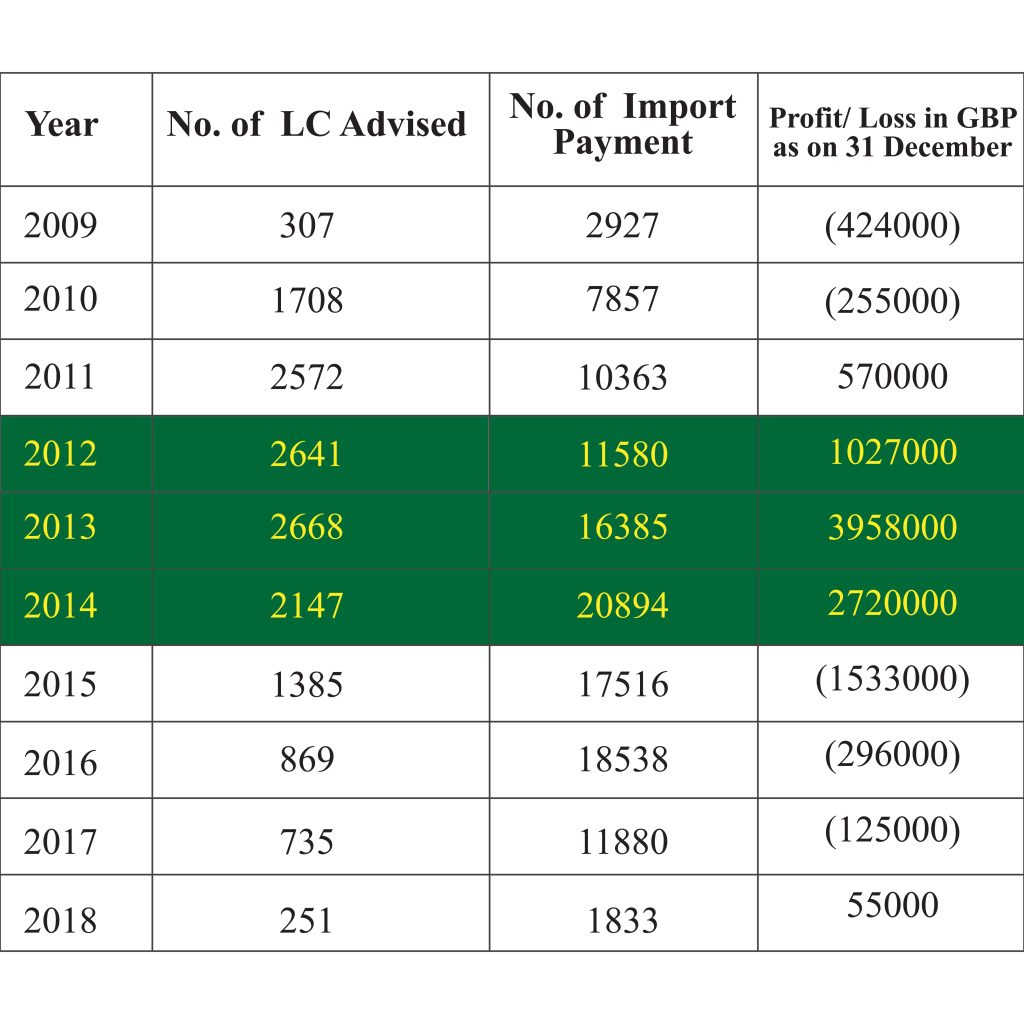

Considering the various business indicators of Sonali Bank (UK) Ltd. from 2009 to 2016, such as the number of LC Advising, number of import payments (reimbursement), and amount of profit, it is seen that before or after joining of the CEO, Mr. Md. Ataur Rahman Pradhan, no one was able to achieve this success as Mr. Prodhan did. On the contrary, the bank suffered severe losses after his departure due to declining business performance.

Talking to Mr. Salauddin Ahmed, who was working in the bank at that time, he said that during the tenure of Md. Ataur Rahman Pradhan, he increased remittance, LC advising, and other business-related finance such as bill discounting, ad confirmation, and re-embezzlement. As a result, Sonali Bank UK became a for-profit organization at that time. And the bank’s image with the government, including the local community, has multiplied.

Its profit in 2011 was 5,70,000 GBP, but in 2012 it increased to 10,27,000 GBP, double the previous year. The performance of 2012 was such a joy that the dividend was officially handed over to the then Finance Minister, Mr. Abul Maal Abdul Muhith, on 13 June 2013 in the Ministry of Finance conference room in the presence of print and electronic media. The success of Sonali Bank (UK) Limited in 2013 is even more enviable. This year, the profit has increased to about four million GBP, almost four times more than the previous year. This is an incredible achievement.

This unimaginable achievement was celebrated again by handing over the dividend to the then Hon’ble Finance Minister, Mr. Abul Maal Abdul Muhith, in the Ministry of Finance conference room. That day the Finance Minister said, today is a pleasant day for us. It looks like it’s an Eid day because Sonali Bank (UK) is paying us dividends when many state-owned enterprises are counting losses.

In 2014, the profit was 27, 20,000 GBP. This year, the GBP has saved 10, 37,000 provisions. At the end of the year, import payments were 20,894, more than double the 10,363 in 2011. On the other hand, the December based performance appraisal shows that (Mr. Md. Ataur Rahman Pradhan joined the head office of Sonali Bank Ltd. after assigning the responsibility in London in May 2015) GBP in 2015, the bank has lost 15, 33, 000, in 2016, 2,96, 000 has been lost and in 2017, the bank has lost 1,25,000 GDP. Originally, after the return of Md. Ataur Rahman Pradhan to Bangladesh, Sonali Bank UK Limited started to face extreme crisis in business.

In a telephone conversation with Mr. Lutfar Rahman, who was working at the time, he said that in the 11 years from 2001 to 2011, Sonali Bank (UK) earned only 870 thousand pounds. And Md. Ataur Rahman Pradhan earned 77 lakh 05 thousand pounds in just 3 years (from 2012-2014) during his tenure as CEO here. On the other hand, in the four years from 2015 to 2016, Sonali Bank (UK) Limited lost 18 lakh 99 thousand pounds.

To explore more Editorials, Please Click Here!